Reports Management

Reports in simpleBillBook provide valuable insights into your business performance, helping you make data-driven decisions. This guide covers all available reports, how to generate them, and how to interpret the data for better business management.

Overview of Reports

Reports help you:

- Track Performance: Monitor sales, purchases, and profitability

- Comply with Regulations: Generate GST-compliant tax reports

- Manage Inventory: Track stock levels and movements

- Control Costs: Analyze expenses and identify savings opportunities

- Make Decisions: Base business decisions on accurate data

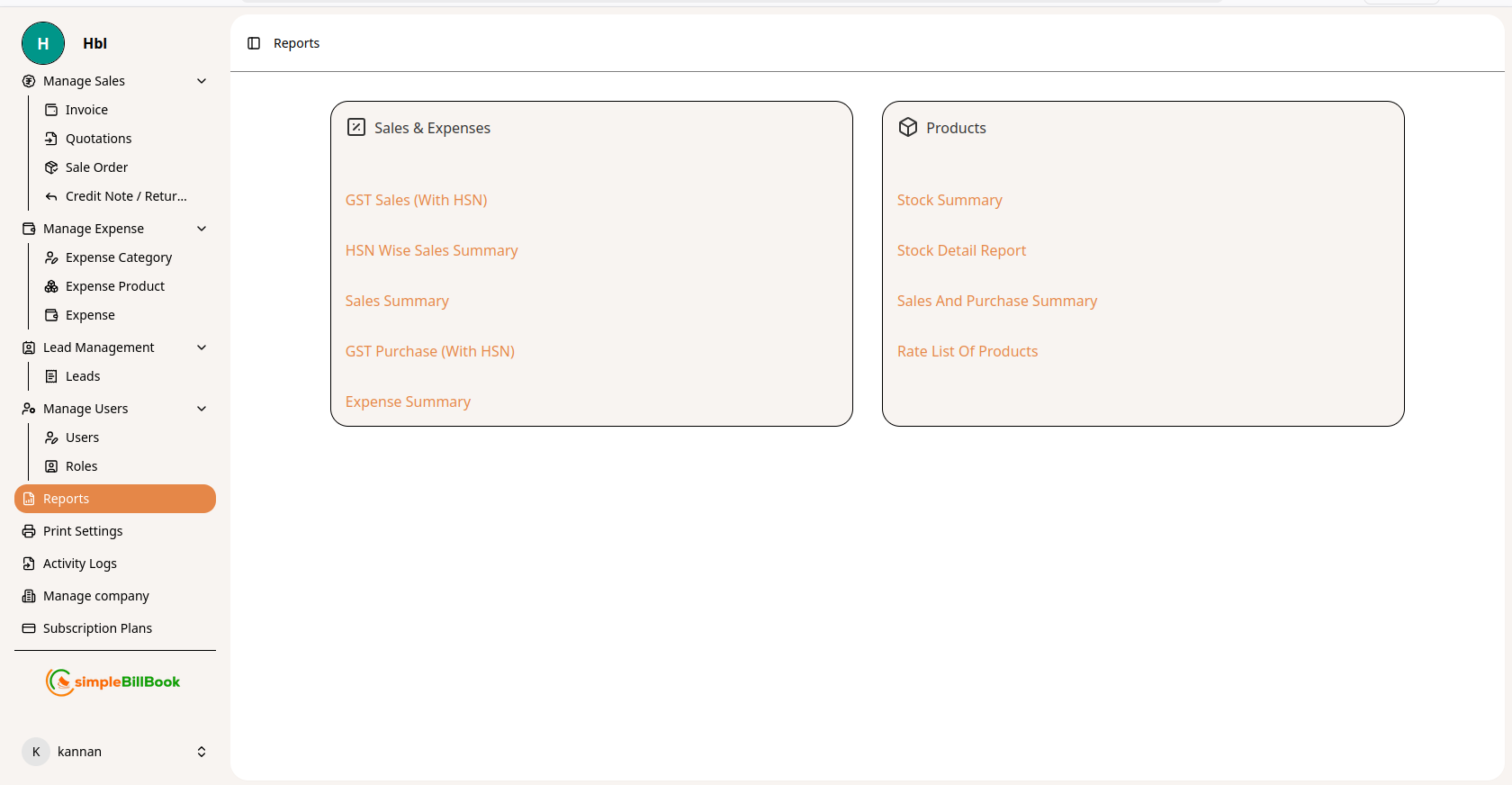

Reports Dashboard

To access reports:

- Navigate to Reports from the main sidebar

- You'll see the main reports menu categorized by business function

Figure 1: Reports dashboard showing all available report categories

Figure 1: Reports dashboard showing all available report categories

Reports Categories:

Sales & Tax Reports

- GST Sales (With HSN)

- HSN Wise Sales Summary

- Sales Summary

- GST Purchase (With HSN)

- Expense Summary

Inventory Reports

- Stock Summary

- Stock Detail Report

- Sales And Purchase Summary

- Rate List Of Products

Sales & Tax Reports

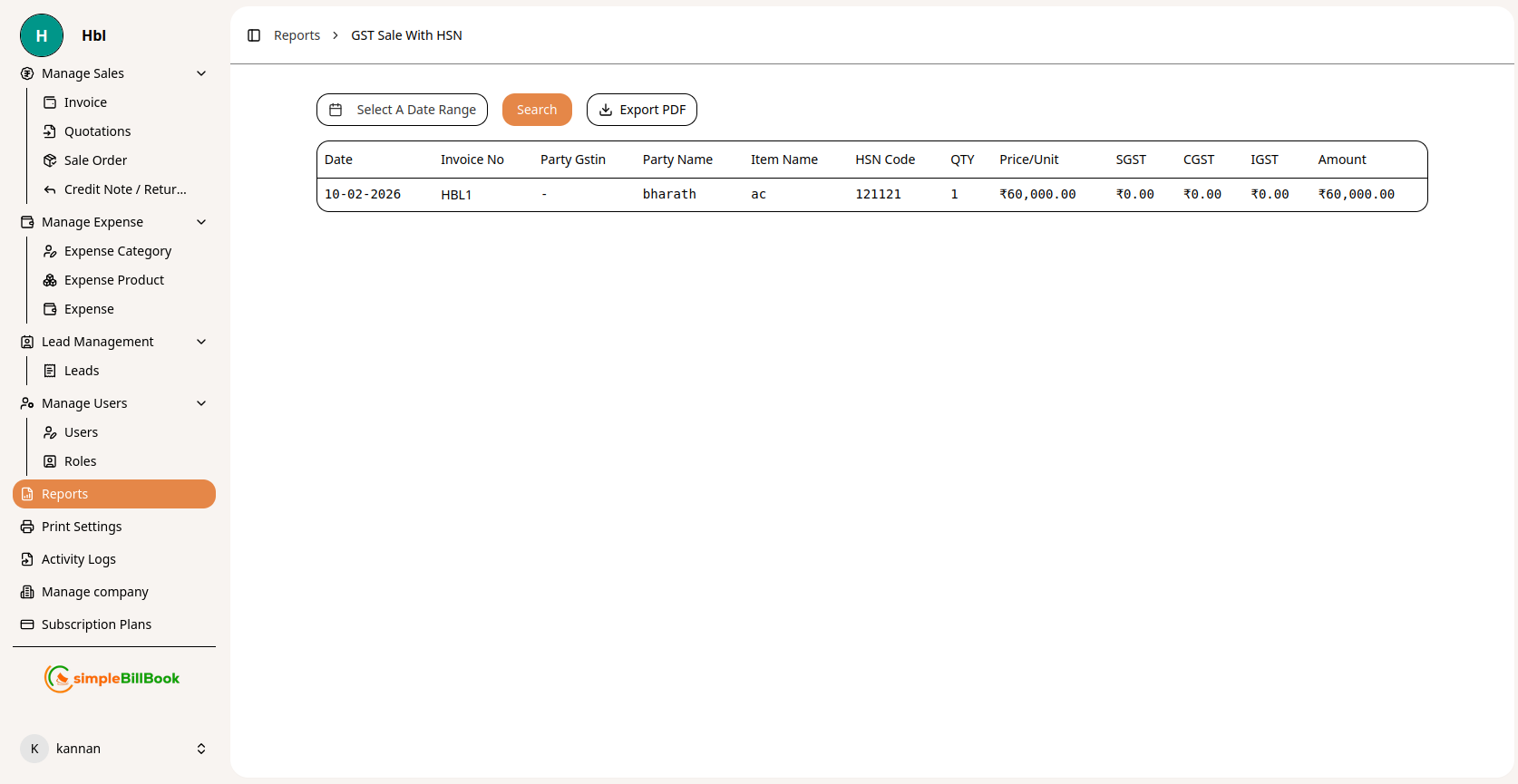

1. GST Sales Report (With HSN)

Figure 2: GST Sales report with HSN code details

Figure 2: GST Sales report with HSN code details

Purpose: Generate GST-compliant sales reports with HSN code classification for tax filing.

Report Columns:

| Column | Description |

|---|---|

| Date | Invoice date |

| Invoice No | Unique sales invoice number |

| Party GSTIN | Customer's GST Identification Number |

| Party Name | Customer name |

| Item Name | Product or service sold |

| HSN Code | Harmonized System of Nomenclature code |

| QTY | Quantity sold |

| Price/Unit | Selling price per unit |

| SGST | State Goods and Services Tax amount |

| CGST | Central Goods and Services Tax amount |

| IGST | Integrated Goods and Services Tax amount |

| Amount | Total invoice amount |

Features:

- Select A Date Range: Filter by custom date period

- Search: Find specific transactions

- Export PDF: Generate printable PDF report

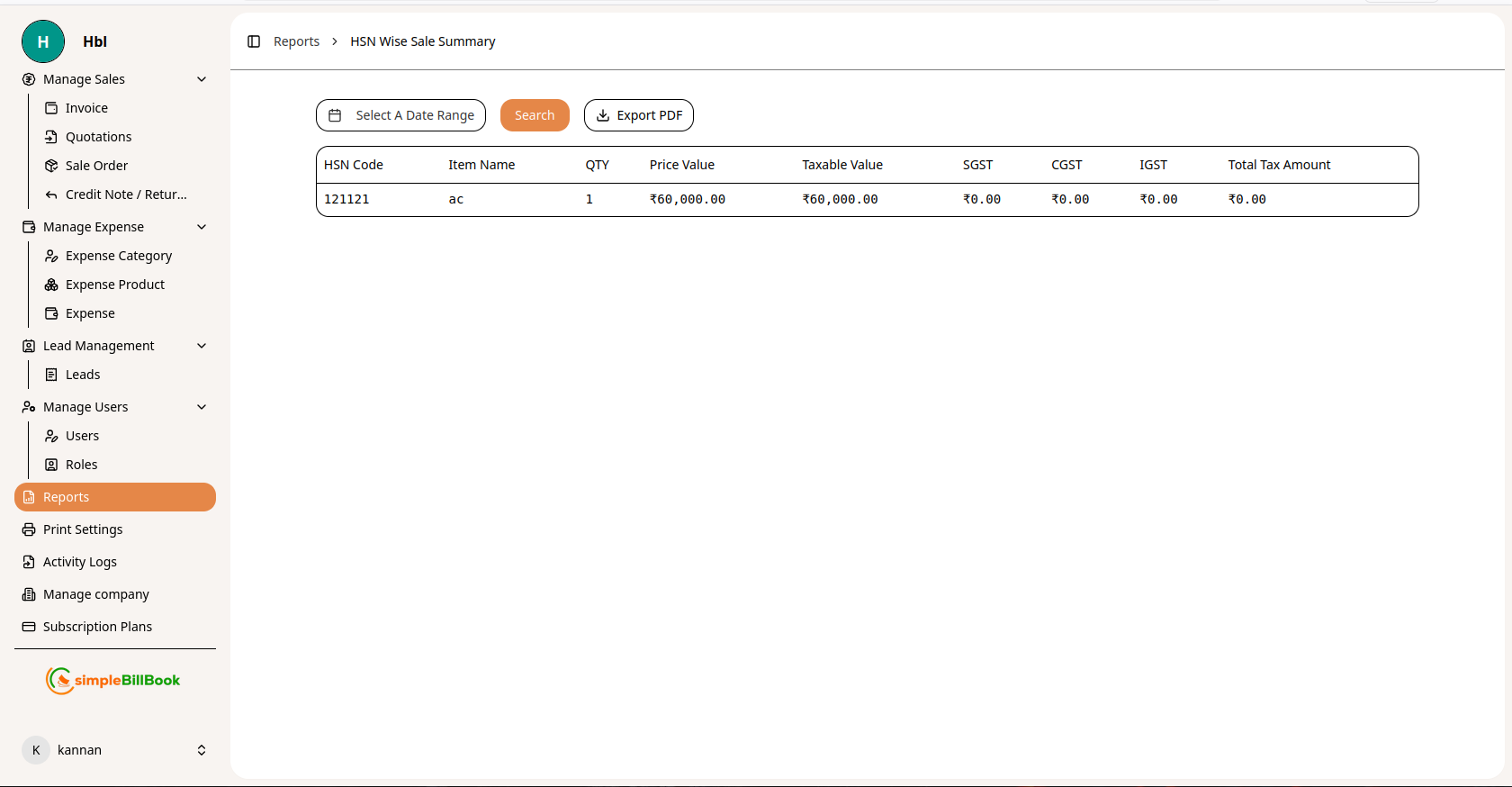

2. HSN Wise Sales Summary

Figure 3: Sales summary grouped by HSN code

Figure 3: Sales summary grouped by HSN code

Purpose: Summarize sales by HSN code for tax classification and reporting.

Report Columns:

| Column | Description |

|---|---|

| HSN Code | Harmonized System of Nomenclature code |

| Item Name | Product name |

| QTY | Total quantity sold |

| Price Value | Total sales value before tax |

| Taxable Value | Value on which tax is calculated |

| SGST | Total State GST collected |

| CGST | Total Central GST collected |

| IGST | Total Integrated GST collected |

| Total Tax Amount | Sum of all taxes |

Use Cases:

- GST return filing

- Tax liability calculation

- Product category performance analysis

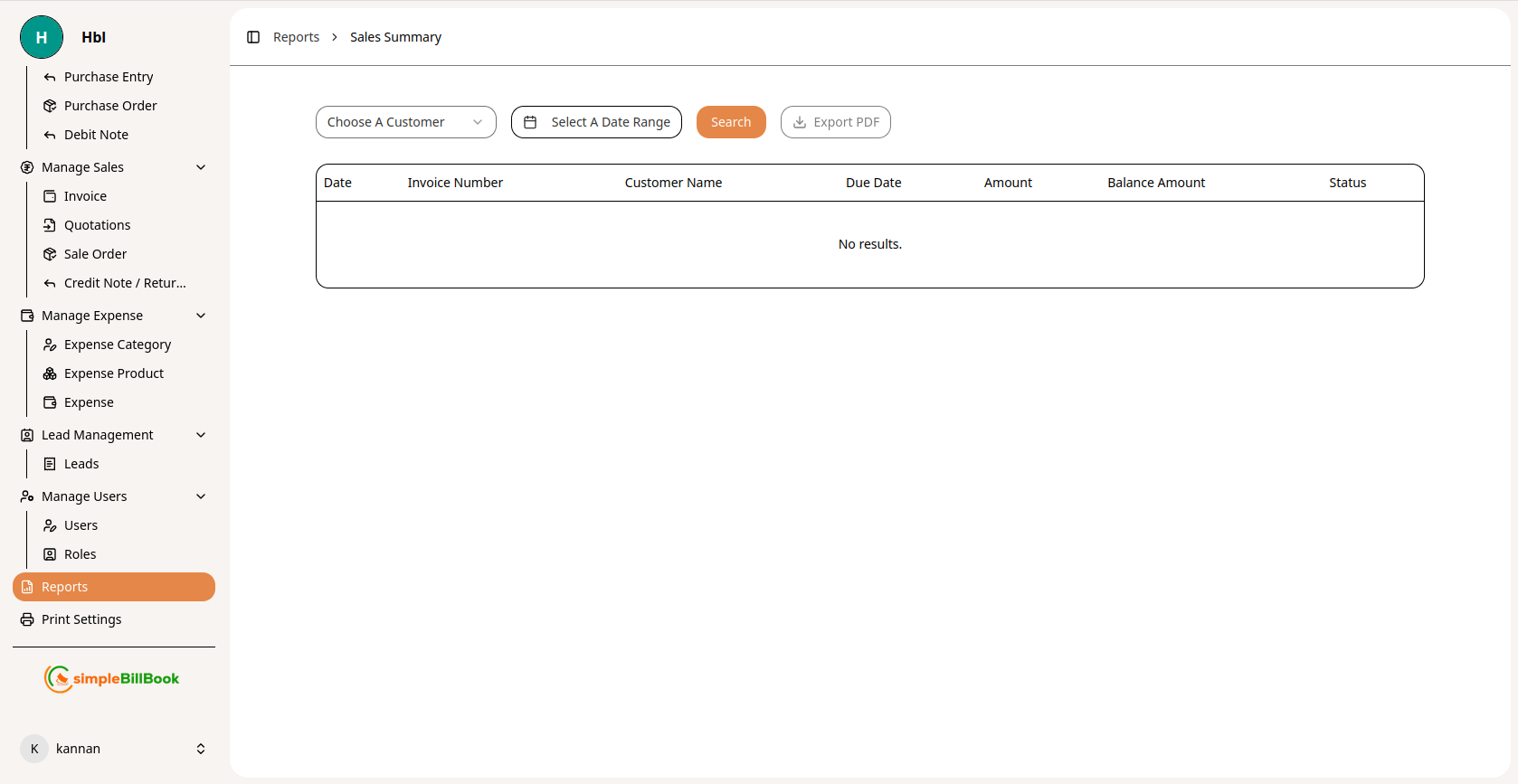

3. Sales Summary Report

Figure 4: Sales summary report by customer and date range

Figure 4: Sales summary report by customer and date range

Purpose: Track and analyze sales transactions with customer-wise details, due dates, and payment status.

Report Columns:

| Column | Description |

|---|---|

| Date | Invoice date |

| Invoice Number | Unique sales invoice identifier |

| Customer Name | Customer name |

| Due Date | Payment due date |

| Amount | Total invoice amount |

| Balance Amount | Outstanding balance to be paid |

| Status | Payment status (Paid, Unpaid, Partial) |

Features:

- Choose A Customer: Filter sales by specific customer

- Select A Date Range: Filter by custom date period

- Search: Find specific invoices or customers

- Export PDF: Generate printable sales summary report

Use Cases:

- Track customer-wise sales performance

- Monitor outstanding receivables

- Identify overdue payments

- Analyze sales trends over time

- Prepare customer statements

Business Insights:

- Which customers generate the most revenue

- Payment patterns and delays by customer

- Seasonal sales variations

- Average collection period

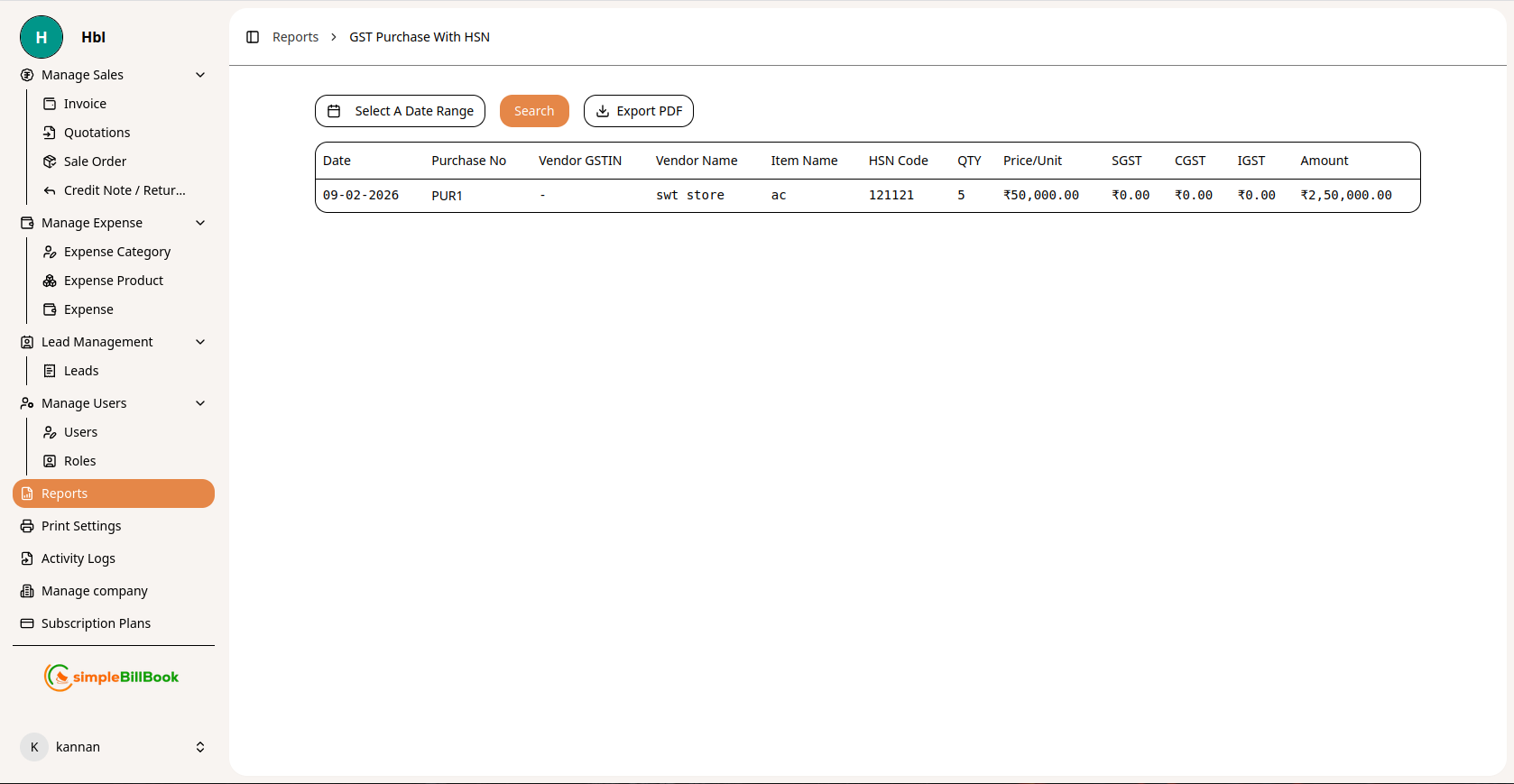

4. GST Purchase Report (With HSN)

Figure 5: GST Purchase report with HSN code details

Figure 5: GST Purchase report with HSN code details

Purpose: Track purchases with GST details for input tax credit claims.

Report Columns:

| Column | Description |

|---|---|

| Date | Purchase date |

| Purchase No | Unique purchase entry number |

| Vendor GSTIN | Vendor's GST Identification Number |

| Vendor Name | Vendor/supplier name |

| Item Name | Product purchased |

| HSN Code | HSN classification code |

| QTY | Quantity purchased |

| Price/Unit | Purchase price per unit |

| SGST | State GST paid |

| CGST | Central GST paid |

| IGST | Integrated GST paid |

| Amount | Total purchase amount |

Features:

- Date Range Filtering: Select custom period

- Search: Find specific purchases

- Export PDF: Download for records or tax filing

Importance:

- Claim input tax credit

- Reconcile with vendor statements

- Track GST paid on purchases

5. Expense Summary

Figure 6: Expense summary report by category

Figure 6: Expense summary report by category

Purpose: Track and analyze business expenses by category.

Report Columns:

| Column | Description |

|---|---|

| Expense Number | Unique expense entry identifier |

| Expense Date | Date expense was incurred |

| Category | Expense category (e.g., digital, home appliance) |

| Quantity | Number of items or units |

| Total Amount | Total expense value |

Features:

- Choose A Category: Filter by specific expense category

- Date Range: Select reporting period

- Search: Find specific expense entries

- Export PDF: Generate expense report

Analysis:

- Identify major expense categories

- Track spending patterns over time

- Budget vs. actual comparison

- Tax deduction preparation

Inventory Reports

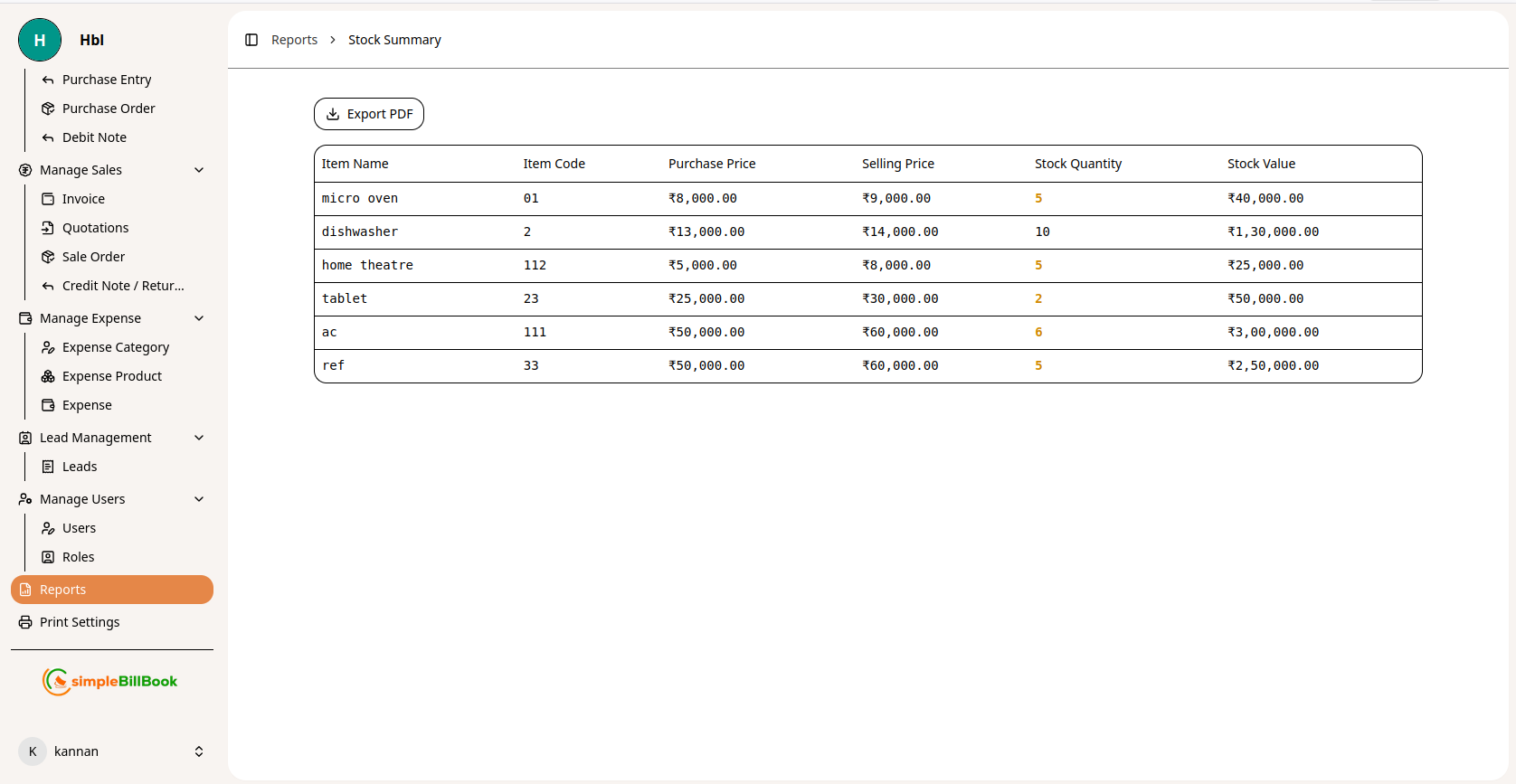

1. Stock Summary Report

Figure 7: Current stock position with quantities and values

Figure 7: Current stock position with quantities and values

Purpose: Get a snapshot of current inventory levels and stock value.

Report Columns:

| Column | Description |

|---|---|

| Item Name | Product name |

| Item Code | Unique product identifier |

| Purchase Price | Cost price per unit |

| Selling Price | Retail price per unit |

| Stock Quantity | Current available quantity |

| Stock Value | Total value of current stock (Qty × Purchase Price) |

Sample Data:

| Item Name | Item Code | Purchase Price | Selling Price | Stock Qty | Stock Value |

|---|---|---|---|---|---|

| micro oven | 01 | ₹8,000.00 | ₹9,000.00 | 5 | ₹40,000.00 |

| dishwasher | 2 | ₹13,000.00 | ₹14,000.00 | 10 | ₹1,30,000.00 |

| home theatre | 112 | ₹5,000.00 | ₹8,000.00 | 5 | ₹25,000.00 |

| tablet | 23 | ₹25,000.00 | ₹30,000.00 | 2 | ₹50,000.00 |

| ac | 111 | ₹50,000.00 | ₹60,000.00 | 6 | ₹3,00,000.00 |

| ref | 33 | ₹50,000.00 | ₹60,000.00 | 5 | ₹2,50,000.00 |

Use Cases:

- Inventory valuation

- Reorder planning

- Capital tied up in inventory

- Profit margin analysis

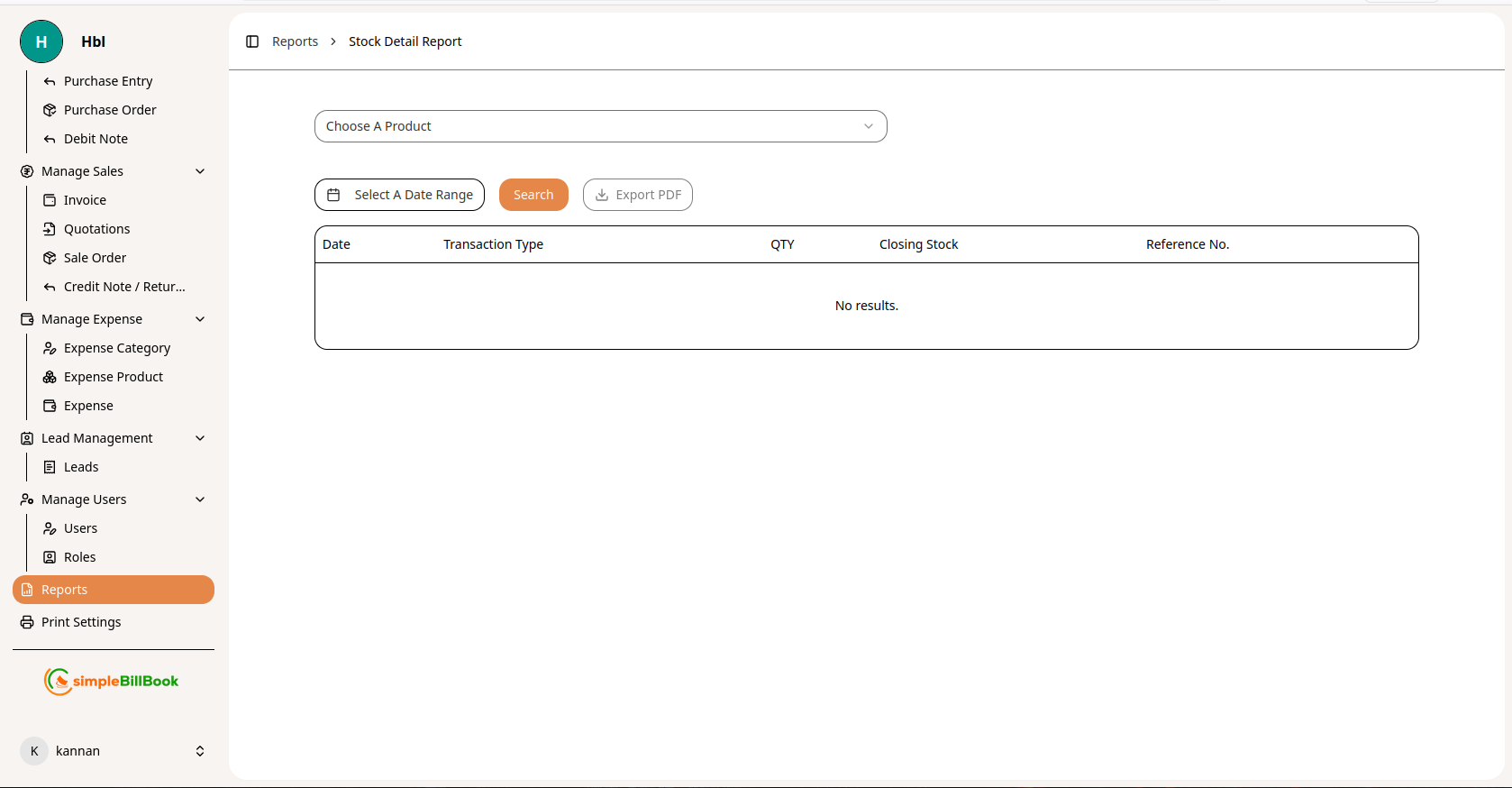

2. Stock Detail Report

Figure 8: Detailed stock movement history for specific products

Figure 8: Detailed stock movement history for specific products

Purpose: Track stock movements and transaction history for individual products.

Report Columns:

| Column | Description |

|---|---|

| Date | Transaction date |

| Transaction Type | Purchase, Sale, Return, Adjustment |

| QTY | Quantity added or removed |

| Closing Stock | Balance after transaction |

| Reference No. | Invoice, purchase, or order number |

Features:

- Choose A Product: Select specific item to analyze

- Search: Find specific transactions

- Export PDF: Download movement history

Analysis:

- Identify fast-moving vs. slow-moving items

- Track stock receipt and issue patterns

- Audit inventory transactions

- Investigate stock discrepancies

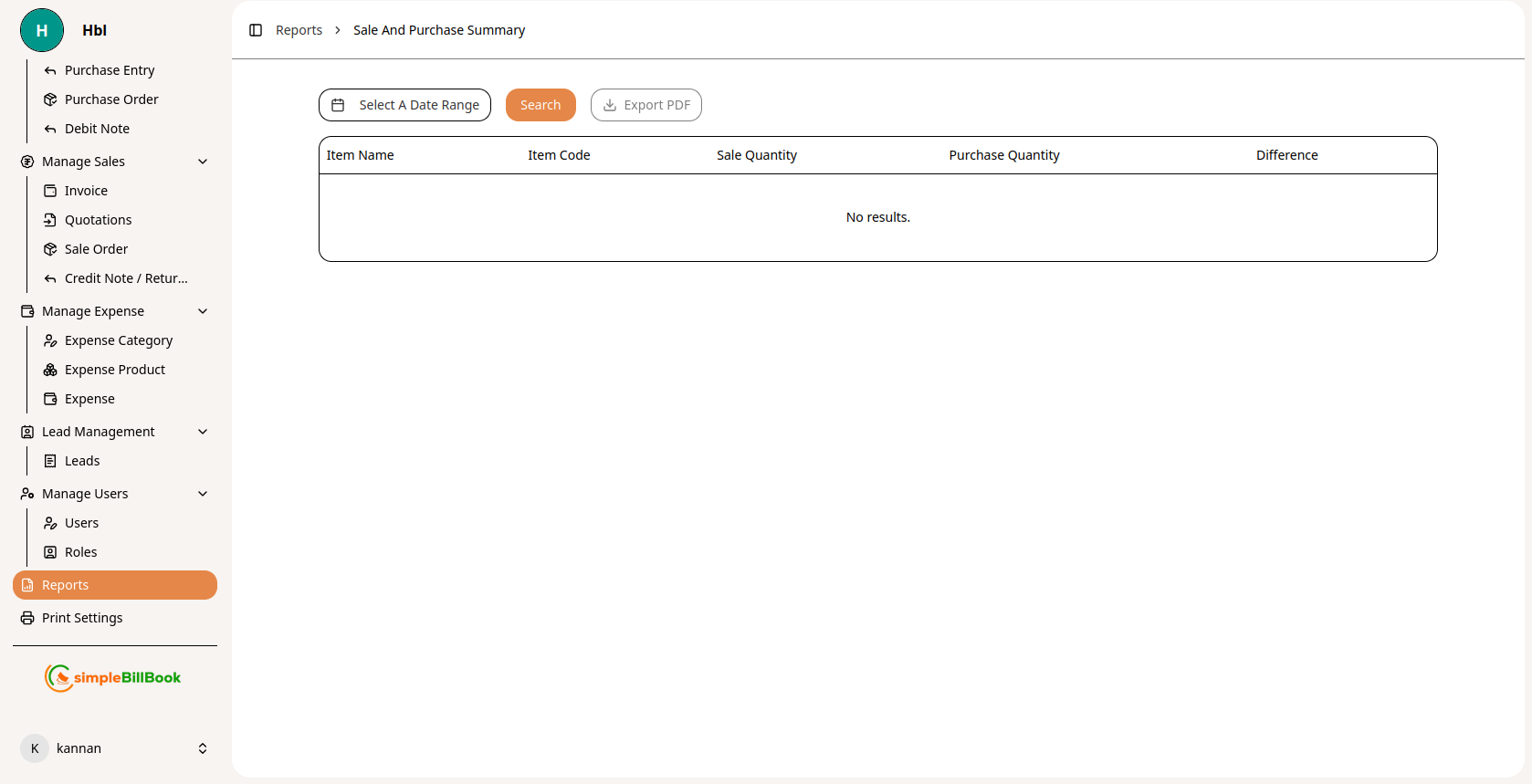

3. Sales And Purchase Summary

Figure 9: Comparison of sales and purchase quantities by product

Figure 9: Comparison of sales and purchase quantities by product

Purpose: Compare sales volume against purchase volume for each product.

Report Columns:

| Column | Description |

|---|---|

| Item Name | Product name |

| Item Code | Unique product identifier |

| Sale Quantity | Total units sold in period |

| Purchase Quantity | Total units purchased in period |

| Difference | Sale Qty - Purchase Qty (net position) |

Features:

- Date Range Selection: Filter by custom period

- Search: Find specific products

- Export PDF: Generate comparative report

Business Insights:

- Identify best-selling products

- Detect stock shortages or excess

- Plan purchasing based on sales velocity

- Calculate stock turnover rate

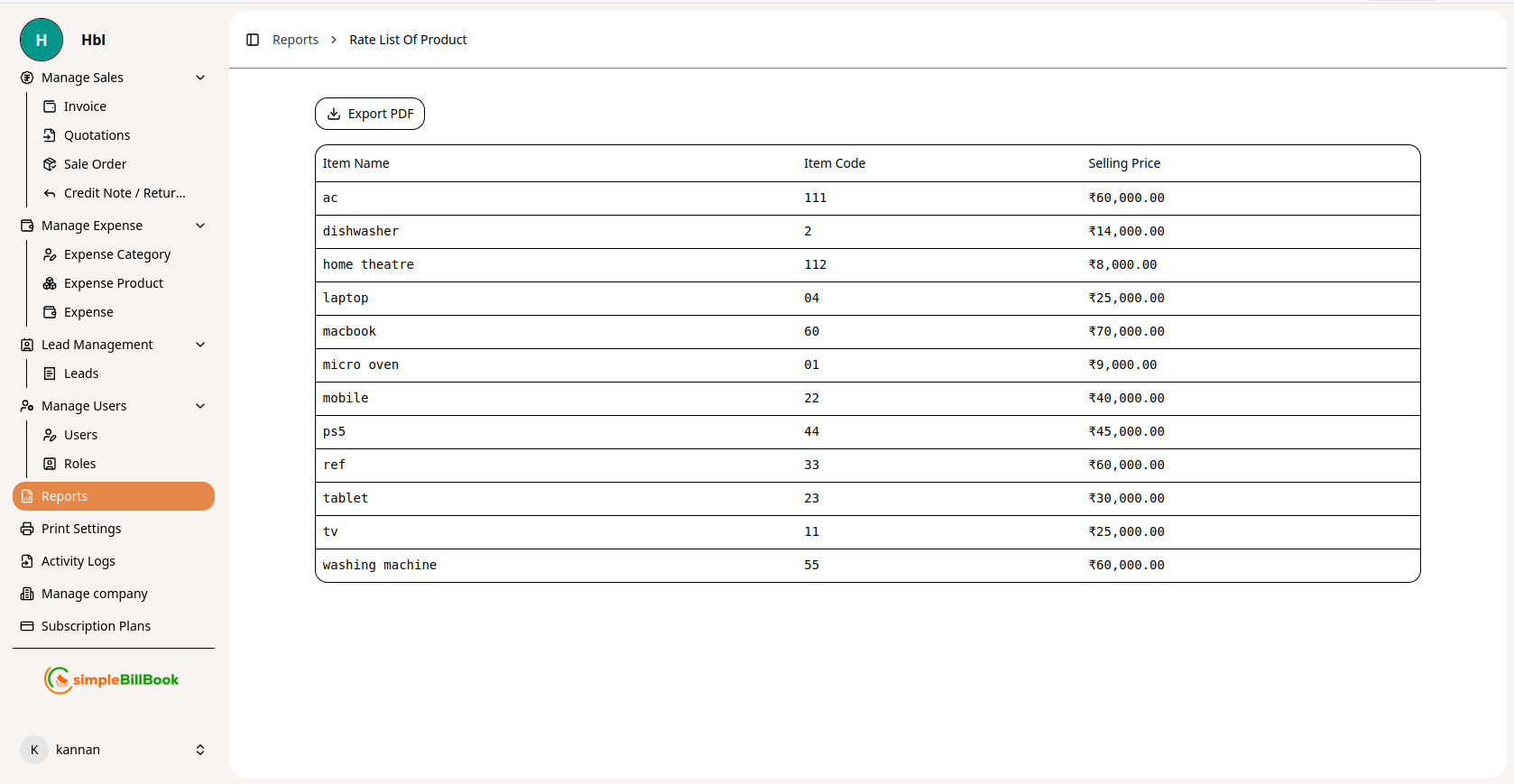

4. Rate List of Products

Figure 10: Complete price list of all products

Figure 10: Complete price list of all products

Purpose: Generate a comprehensive price list for all products with selling prices.

Report Columns:

| Column | Description |

|---|---|

| Item Name | Product name |

| Item Code | Unique product identifier |

| Selling Price | Current retail price |

Sample Data:

| Item Name | Item Code | Selling Price |

|---|---|---|

| ac | 111 | ₹60,000.00 |

| dishwasher | 2 | ₹14,000.00 |

| home theatre | 112 | ₹8,000.00 |

| laptop | 04 | ₹25,000.00 |

| macbook | 60 | ₹70,000.00 |

| micro oven | 01 | ₹9,000.00 |

| mobile | 22 | ₹40,000.00 |

| ps5 | 44 | ₹45,000.00 |

| ref | 33 | ₹60,000.00 |

| tablet | 23 | ₹30,000.00 |

| tv | 11 | ₹25,000.00 |

| washing machine | 55 | ₹60,000.00 |

Use Cases:

- Share price list with customers

- Train sales staff on pricing

- Audit price consistency

- Prepare catalogs and quotations

Common Report Features

Date Range Selection

Most reports include date range filters allowing you to:

- Select predefined periods (Today, This Week, This Month, This Quarter, This Year)

- Set custom start and end dates

- Compare periods (Month-over-Month, Year-over-Year)

Search Functionality

- Search across all columns

- Find specific transactions, customers, vendors, or products

- Filter by keywords or exact matches

Customer Filtering

Reports like Sales Summary allow filtering by:

- Specific customer to view their transaction history

- All customers for complete overview

- Customer groups or categories

Export Options

- Export PDF: Generate formatted PDF reports for printing or sharing

- Format may include company logo, headers, and footers

- Professional presentation for clients or tax authorities

Best Practices for Report Generation

1. Regular Reporting Schedule

- Daily: Quick sales and cash position

- Weekly: Sales trends, stock movement

- Monthly: Complete financial and GST reports

- Quarterly: Business performance review

- Annually: Annual summary for tax filing

2. Data Accuracy

- Ensure all transactions are entered correctly

- Reconcile reports with bank statements

- Investigate and correct discrepancies promptly

- Maintain clean master data (HSN codes, product details)

3. Report Interpretation

- Understand what each metric represents

- Compare against historical data for trends

- Look for anomalies or unusual patterns

- Share insights with relevant team members

4. Documentation

- Save critical reports for audit trail

- Maintain organized report archive

- Document report definitions and calculations

- Note any adjustments or corrections

5. Compliance

- Ensure GST reports match filed returns

- Retain reports as required by tax laws

- Generate reports before tax due dates

- Verify HSN code accuracy

Integration with Other Modules

Sales Module:

- GST Sales Report: Pulls data from sales invoices

- Sales Summary: Aggregates customer-wise sales data

- HSN Summary: Aggregates by product classification

- Rate List: Uses current selling prices

Customer Management:

- Sales Summary: Links to customer profiles

- Customer Filtering: View sales by specific customer

- Outstanding Tracking: Monitor customer balances

Purchase Module:

- GST Purchase Report: Uses purchase entry data

- Input Tax Credit: Tracks GST paid on purchases

Inventory Module:

- Stock Summary: Real-time inventory position

- Stock Detail: Transaction history by product

- Sale vs. Purchase: Comparative analysis

Expense Module:

- Expense Summary: Categorized expenditure tracking

Common Scenarios and Solutions

Scenario 1: Preparing for GST Return Filing

Solution:

- Generate GST Sales (With HSN) report for the tax period

- Generate HSN Wise Sales Summary for classification

- Generate GST Purchase (With HSN) report for input tax credit

- Verify totals against GSTR-1 and GSTR-3B requirements

- Export PDF for records and audit trail

Scenario 2: Monthly Business Review Meeting

Solution:

- Run Sales Summary for month-over-month comparison

- Filter by customer to identify top clients

- Generate Expense Summary by category

- Check Stock Summary for inventory health

- Prepare Rate List for pricing review

- Export all reports to PDF for presentation

Scenario 3: Customer Account Statement

Solution:

- Navigate to Sales Summary report

- Select specific customer from "Choose A Customer" dropdown

- Set appropriate date range

- View all invoices with due dates and balances

- Export PDF to share with customer

Scenario 4: Stock Audit and Reorder Planning

Solution:

- Run Stock Summary to identify low-stock items

- Generate Sales And Purchase Summary for movement analysis

- Check Stock Detail Report for fast-moving items

- Create purchase orders based on data

Scenario 5: Overdue Payment Tracking

Solution:

- Generate Sales Summary report

- Filter by date range

- Sort by due date and balance amount

- Identify customers with overdue invoices

- Initiate collection follow-up

Scenario 6: Expense Control Review

Solution:

- Generate Expense Summary by date range

- Filter by category to identify high-cost areas

- Compare with previous periods

- Investigate significant increases

- Implement cost control measures