Expense Category Management

Expense Category management in Hbl's simpleBillBook allows you to organize and categorize business expenses systematically. Proper expense categorization helps in financial analysis, budgeting, tax preparation, and understanding business spending patterns.

Overview of Expense Categories

Expense Categories serve as organizational tools for classifying business expenditures. They provide:

- Financial Organization: Systematic grouping of expenses

- Budget Tracking: Monitor spending against budgets by category

- Tax Preparation: Simplify tax deduction calculations

- Spending Analysis: Identify areas of high expenditure

- Cost Control: Monitor and control spending by category

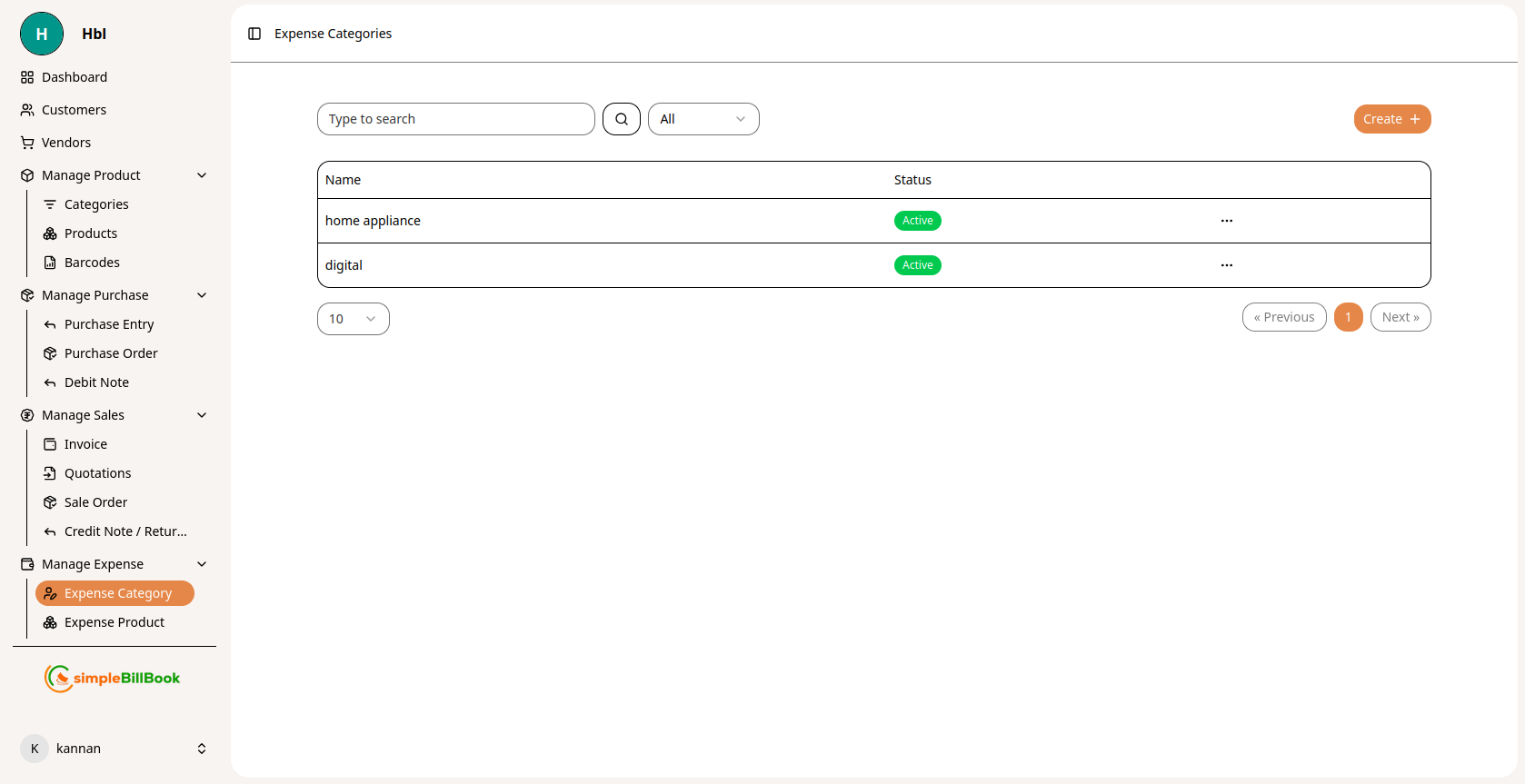

Viewing Expense Categories

To view all expense categories:

- Navigate to Manage Expense → Expense Category from the main sidebar

- You'll see a table listing all expense categories

Figure 1: Expense categories list showing all categories with status

Figure 1: Expense categories list showing all categories with status

Expense Category Table Columns:

Category Information:

- Name: Category name (e.g., Home Appliance, Digital, etc.)

- Status: Active/Inactive status

- Other Details: May include description, code, or other attributes

Interface Elements:

- Type to search: Search functionality for finding specific categories

- All dropdown: Filter by status (Active/Inactive/All)

- Pagination: Navigation controls (Previous, Next buttons)

- Items per page: Typically displays 10 items per page

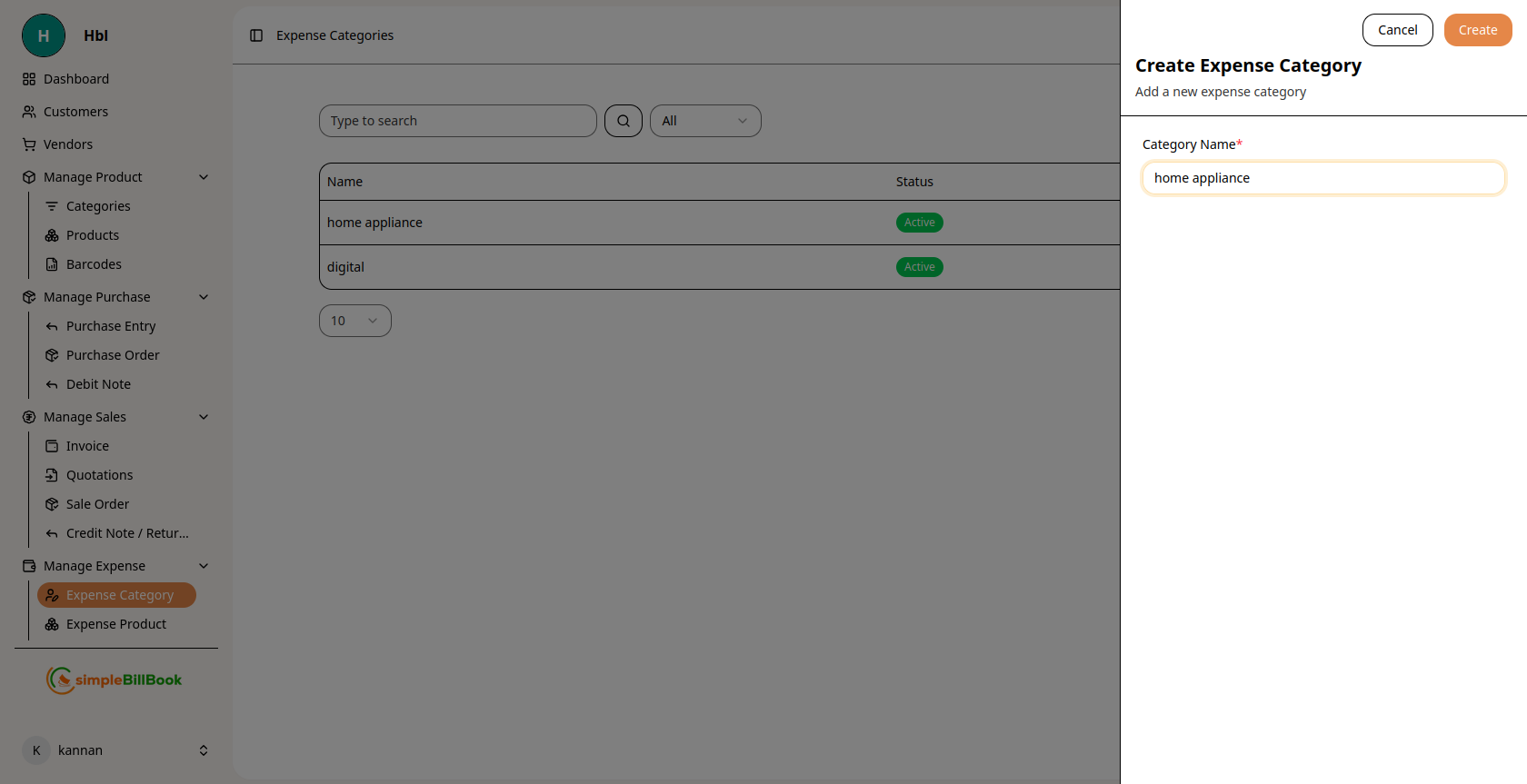

Creating a New Expense Category

Step 1: Access Category Creation

From the expense categories page, click Create Expense Category or similar button.

Step 2: Fill Category Details

Figure 2: Form for creating new expense categories

Figure 2: Form for creating new expense categories

Required Information:

- Category Name*: Descriptive name for the expense category (required)

- Description: Optional detailed description of the category

- Status: Set as Active or Inactive (Active categories are available for expense assignment)

- Category Code: Optional unique code for the category

- Parent Category: Option to create sub-categories under main categories

Category Name Guidelines:

- Use clear, descriptive names

- Be consistent with naming conventions

- Consider future expansion needs

- Align with accounting/tax categories if possible

Step 3: Save Category

- Click Save to create the category

- Click Cancel to discard the category

- System validates for duplicate names if applicable

Types of Expense Categories

Common Expense Category Examples:

1. Operating Expenses:

- Office Supplies

- Utilities (Electricity, Water, Internet)

- Rent and Lease Payments

- Maintenance and Repairs

- Insurance Premiums

2. Personnel Expenses:

- Salaries and Wages

- Employee Benefits

- Training and Development

- Recruitment Costs

- Payroll Taxes

3. Marketing and Sales:

- Advertising Costs

- Promotional Materials

- Trade Shows and Events

- Website Maintenance

- Sales Commissions

4. Travel and Entertainment:

- Business Travel

- Meals and Entertainment

- Transportation Costs

- Accommodation

- Conference Fees

5. Technology and Equipment:

- Software Licenses

- Hardware Purchases

- IT Services

- Equipment Maintenance

- Cloud Services

6. Professional Services:

- Legal Fees

- Accounting Services

- Consulting Fees

- Professional Memberships

- Bank Charges

Best Practices for Expense Category Management

Creating Effective Categories:

- Logical Grouping: Create categories that logically group similar expenses

- Hierarchical Structure: Consider main categories and sub-categories

- Consistent Naming: Use consistent naming conventions across all categories

- Future-Proofing: Create categories that can accommodate future expense types

- Alignment: Align with accounting standards and tax categories

Category Organization:

- Avoid Overlap: Ensure categories don't overlap to prevent confusion

- Limit Number: Don't create too many categories (aim for 15-25 main categories)

- Regular Review: Periodically review and update categories

- User Training: Ensure all users understand category definitions

- Documentation: Maintain documentation of what each category includes

Status Management:

- Active vs. Inactive: Use Active status for current categories, Inactive for discontinued ones

- Category Changes: Consider impact before changing existing categories

- Historical Data: Inactive categories preserve historical expense data

- Cleanup Schedule: Regular cleanup of unused categories

Integration with Expense Entry

Assigning Categories to Expenses:

- When creating expense entries, select appropriate category

- System may suggest categories based on expense type

- Users should be trained on proper category selection

- Consider mandatory category assignment for all expenses

Reporting by Category:

- Generate expense reports filtered by category

- Compare actual vs. budget by category

- Analyze spending patterns by category over time

- Identify areas for cost reduction

Common Scenarios and Solutions

Scenario 1: New Type of Expense Emerges

Solution:

- Assess if existing category covers the expense

- If not, create new category with clear definition

- Train users on when to use new category

- Update expense policies if needed

Scenario 2: Category Becomes Too Broad

Solution:

- Split into sub-categories for better tracking

- Update historical data if possible

- Communicate changes to all users

- Update reporting templates

Scenario 3: Similar Categories Causing Confusion

Solution:

- Review category definitions

- Merge similar categories if appropriate

- Clarify definitions for remaining categories

- Provide examples of what belongs in each category

Scenario 4: Tax Reporting Requirements Change

Solution:

- Review tax reporting requirements

- Adjust categories to align with tax classifications

- Update category definitions and training

- Consider adding tax-specific attributes to categories

Reports and Analytics

Available Expense Category Reports:

- Expense Summary by Category: Total expenses by category for period

- Category Comparison: Compare spending across categories

- Budget vs. Actual by Category: Monitor budget adherence

- Category Trend Analysis: Spending patterns over time by category

- Category Utilization Report: How frequently each category is used

Key Metrics to Monitor:

- Category Distribution: Percentage of total expenses by category

- Category Growth: Spending increases/decreases by category

- Budget Variance: Actual vs. budget by category

- Category Efficiency: Cost-effectiveness of spending by category

- Compliance Rate: Percentage of expenses properly categorized