Purchase Management

Purchase management in simpleBillBook helps you track inventory procurement from vendors, manage purchase orders, and maintain accurate stock records. This guide covers creating purchase entries, configuring purchase settings, and managing vendor transactions.

Overview of Purchase Management

Purchase management consists of three main components accessible from the sidebar:

- Purchase Entry: Record actual purchases from vendors

- Purchase Order: Create purchase orders for future procurement

- Debit Note: Handle returns or adjustments with vendors

Viewing Purchase History

To view all purchase records:

- Navigate to Manage Purchase → Purchase Entry from the main sidebar

- You'll see a comprehensive table of all purchase transactions

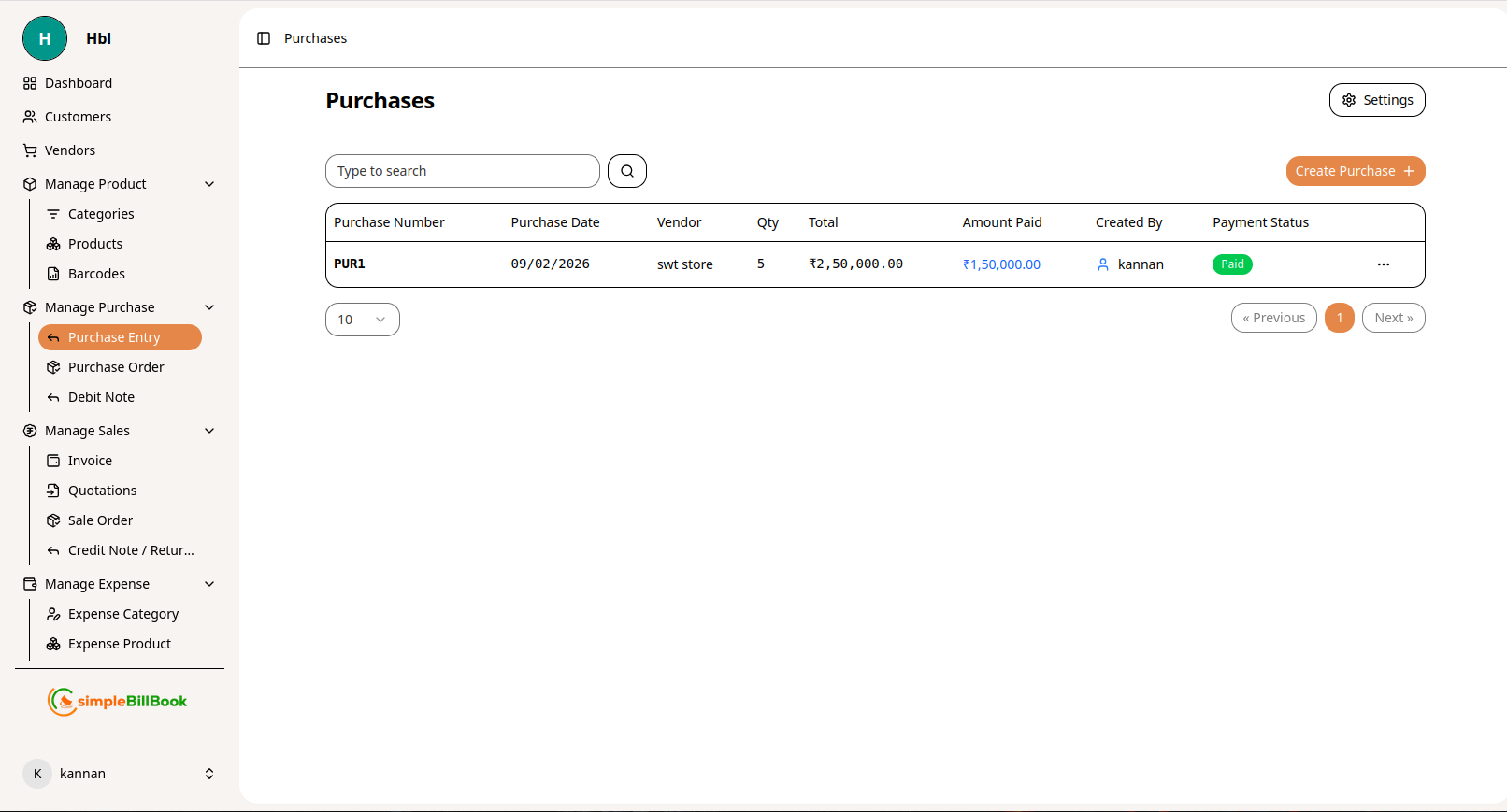

Figure 1: Purchase entries list showing transaction history

Figure 1: Purchase entries list showing transaction history

Purchase Table Columns:

Transaction Details:

- Purchase Number: Unique identifier (e.g., PUR1, PUR2)

- Purchase Date: Date of purchase

- Vendor: Vendor name

- Qty: Total quantity of items purchased

Financial Information:

- Total: Total purchase amount

- Amount Paid: Amount already paid to vendor

- Payment Status: Paid/Unpaid status

- Created By: User who created the purchase entry

Search and Filter:

- Type to search: Search by purchase number, vendor, or other criteria

- Pagination: Navigate through multiple pages of purchase records

Creating a New Purchase Entry

Step 1: Access Purchase Creation

From the purchase entries page, click Add Purchase or similar button to create a new purchase.

Step 2: Fill Purchase Details

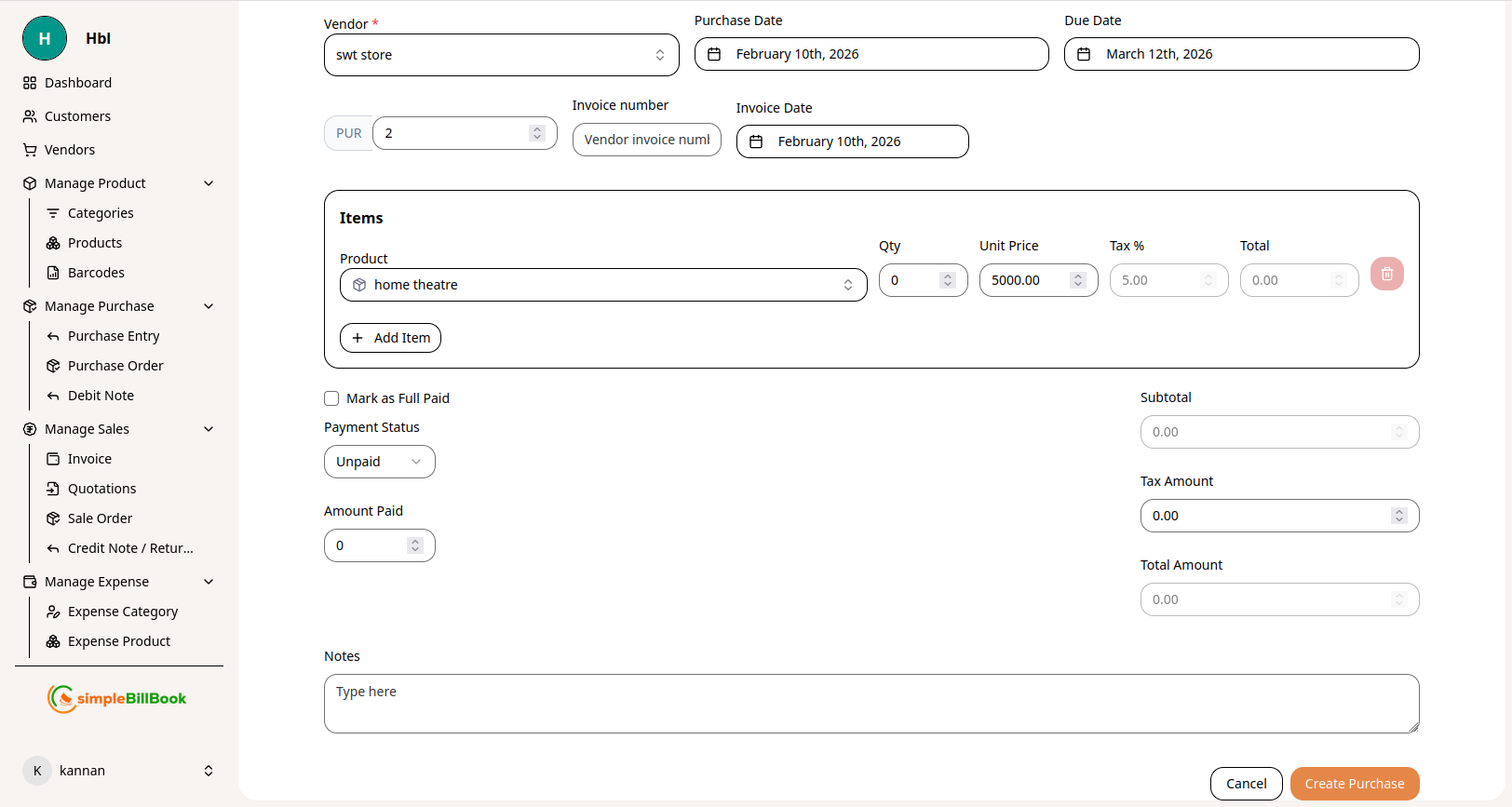

Figure 2: Form for creating new purchase entries

Figure 2: Form for creating new purchase entries

Vendor Information:

- **Vendor ***: Select vendor from dropdown (required field)

- Invoice number: Auto-generated (PUR2 in example) based on settings

- Vendor invoice number: Optional - vendor's reference number

Item Selection:

- Click + Add Item to add products to the purchase

- Select Product from dropdown (e.g., home theatre)

- Enter quantity, unit price, and other details for each item

- Add multiple items as needed

Payment Information:

- Mark as Full Paid: Checkbox to indicate complete payment

- Payment Status: Auto-updates based on payment (Unpaid/Paid/Partial)

- Amount Paid: Enter amount paid at time of purchase

Additional Details:

- Notes: Add any relevant notes or terms

- Purchase Date: Defaults to current date (editable)

Step 3: Save Purchase

After filling all details, save the purchase entry. The system will:

- Update inventory stock levels

- Create payable entry for vendor (if unpaid)

- Generate purchase number

Purchase Settings Configuration

Accessing Purchase Settings

From the purchase management section, access settings (typically via gear icon or Settings menu).

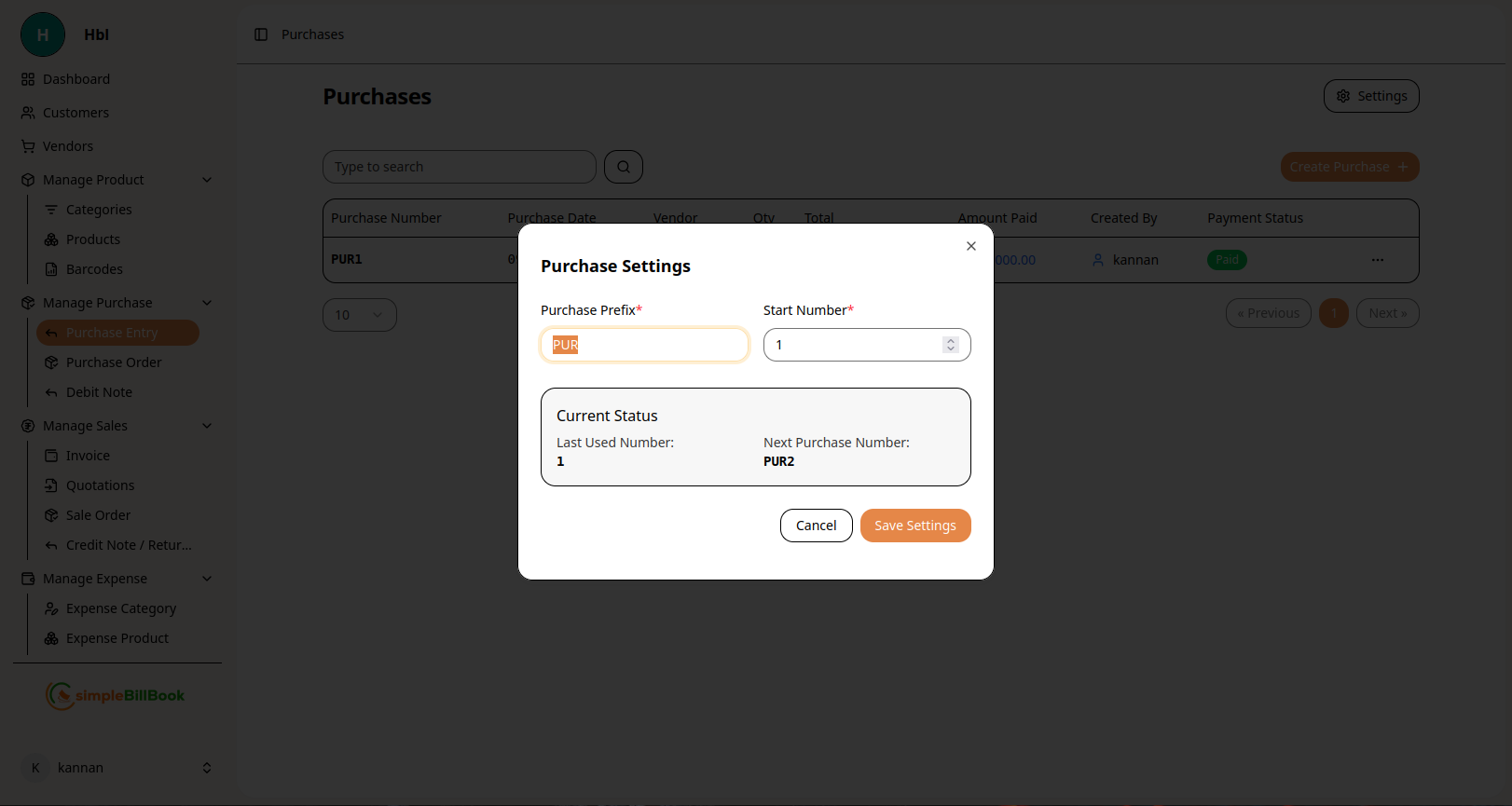

Figure 3: Purchase numbering and configuration settings

Figure 3: Purchase numbering and configuration settings

Configurable Settings:

Purchase Numbering:

- Purchase Prefix: Custom prefix for purchase numbers (default: PUR)

- Start Number: Starting sequence number

- Last Used Number: System tracks last generated number

- Next Purchase Number: Preview of next auto-generated number

Display Settings:

- Purchase Date Format: Configure date display format

- Default Payment Terms: Set standard payment terms

- Tax Settings: Configure default tax rates

Saving Settings:

- Click Save Settings to apply changes

- Use Cancel to discard modifications

- Settings affect all future purchase entries

Purchase Workflow: Step-by-Step

Complete Purchase Process:

1. Pre-Purchase Preparation:

- Ensure vendors are added in Vendors section

- Verify products exist in inventory

- Check purchase settings are configured

2. Creating Purchase Entry:

- Select vendor from existing list

- Add purchased items with quantities and prices

- Set payment status and terms

- Add any special notes

3. Post-Purchase Actions:

- Stock Update: Inventory automatically increases

- Vendor Payable: Amount added to vendor's account

- Document Generation: Purchase receipt created

4. Payment Processing:

- Record partial or full payments

- Update payment status

- Track outstanding balances

Types of Purchase Transactions

1. Standard Purchase Entry

- Record completed purchases

- Immediate stock update

- Vendor payment tracking

2. Purchase Order (Future Order)

- Create orders for future delivery

- No immediate stock impact

- Track expected deliveries

3. Debit Note (Purchase Return)

- Handle returns to vendors

- Reduce stock levels

- Adjust vendor payables

Best Practices for Purchase Management

Vendor Management:

- Verified Vendors: Only purchase from verified, active vendors

- Payment Terms: Negotiate and record clear payment terms

- Documentation: Keep vendor invoices and correspondence

Purchase Recording:

- Timely Entry: Record purchases immediately upon receipt

- Accurate Quantities: Verify received quantities match purchase

- Price Validation: Confirm prices match purchase agreements

- Tax Compliance: Ensure proper tax recording and calculations

Inventory Integration:

- Stock Updates: Verify inventory updates after purchase

- Quality Checks: Inspect goods before updating stock

- Barcode Generation: Generate barcodes for new stock items

Financial Controls:

- Approval Workflow: Implement purchase approval processes

- Budget Adherence: Monitor purchases against budgets

- Payment Scheduling: Schedule payments to optimize cash flow

Common Scenarios and Solutions

Scenario 1: Partial Shipment Received

Solution:

- Create purchase entry for received items only

- Note remaining items as pending

- Update purchase when remaining items arrive

Scenario 2: Price Discrepancy

Solution:

- Record purchase at invoiced price

- Contact vendor for clarification

- Create debit note for adjustments if needed

Scenario 3: Damaged Goods Received

Solution:

- Do not update inventory for damaged items

- Create debit note for return

- Record only good items in purchase entry

Scenario 4: Bulk Purchase with Multiple Items

Solution:

- Use + Add Item for each product

- Group related items in single purchase

- Apply appropriate taxes to each item type

Integration with Other Modules

Inventory Management:

- Automatic Stock Update: Purchases increase stock levels

- Stock Value Calculation: Updates average cost and total value

- Reorder Points: Can trigger reorder alerts

Vendor Management:

- Purchase History: Tracks all transactions with each vendor

- Payable Tracking: Monitors outstanding balances

- Performance Metrics: Analyzes vendor reliability and pricing

Financial Accounting:

- Expense Recording: Purchases recorded as expenses or inventory

- Tax Reporting: Captures input tax credits

- Cash Flow Management: Tracks outgoing payments

Reporting and Analytics:

- Purchase Reports: Monthly, quarterly, annual purchase summaries

- Vendor Analysis: Spending by vendor category

- Inventory Valuation: Cost of goods purchased