Invoice Management (Sales)

Invoice management in Hbl's simpleBillBook allows you to create sales invoices, track customer transactions, and manage receivables. This guide covers creating sales invoices, configuring invoice settings, and managing the complete sales cycle.

Overview of Sales Invoices

Sales invoices are formal documents issued to customers for goods sold or services rendered. They serve as:

- Legal records of sale

- Payment requests

- Tax documentation

- Inventory reduction triggers

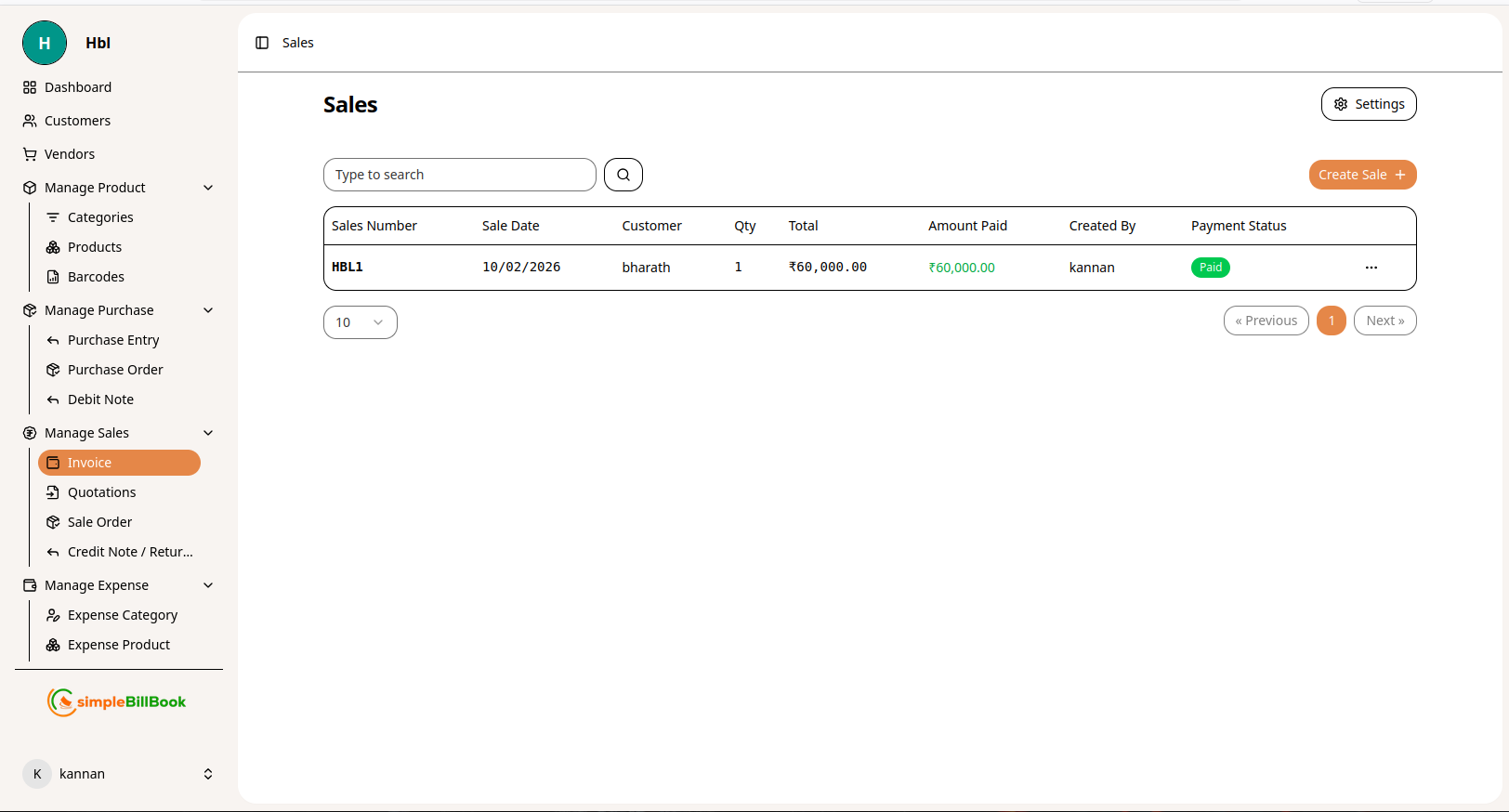

Viewing Sales Invoices

To view all sales invoices:

- Navigate to Manage Sales → Invoice from the main sidebar

- You'll see a table listing all sales transactions

Figure 1: Sales invoices list showing all transactions with payment status

Figure 1: Sales invoices list showing all transactions with payment status

Sales Invoice Table Columns:

Transaction Details:

- Sales Number: Unique invoice number (e.g., HBL1, HBL2)

- Sale Date: Date of sale

- Customer: Customer name

- Qty: Total quantity of items sold

Financial Information:

- Total: Total invoice amount

- Amount Paid: Amount received from customer

- Payment Status: Paid/Unpaid/Partial status

- Created By: User who created the invoice

Search and Navigation:

- Type to search: Search by sales number, customer, or date

- Pagination: Navigate through invoice pages

- Status Filters: Filter by payment status if available

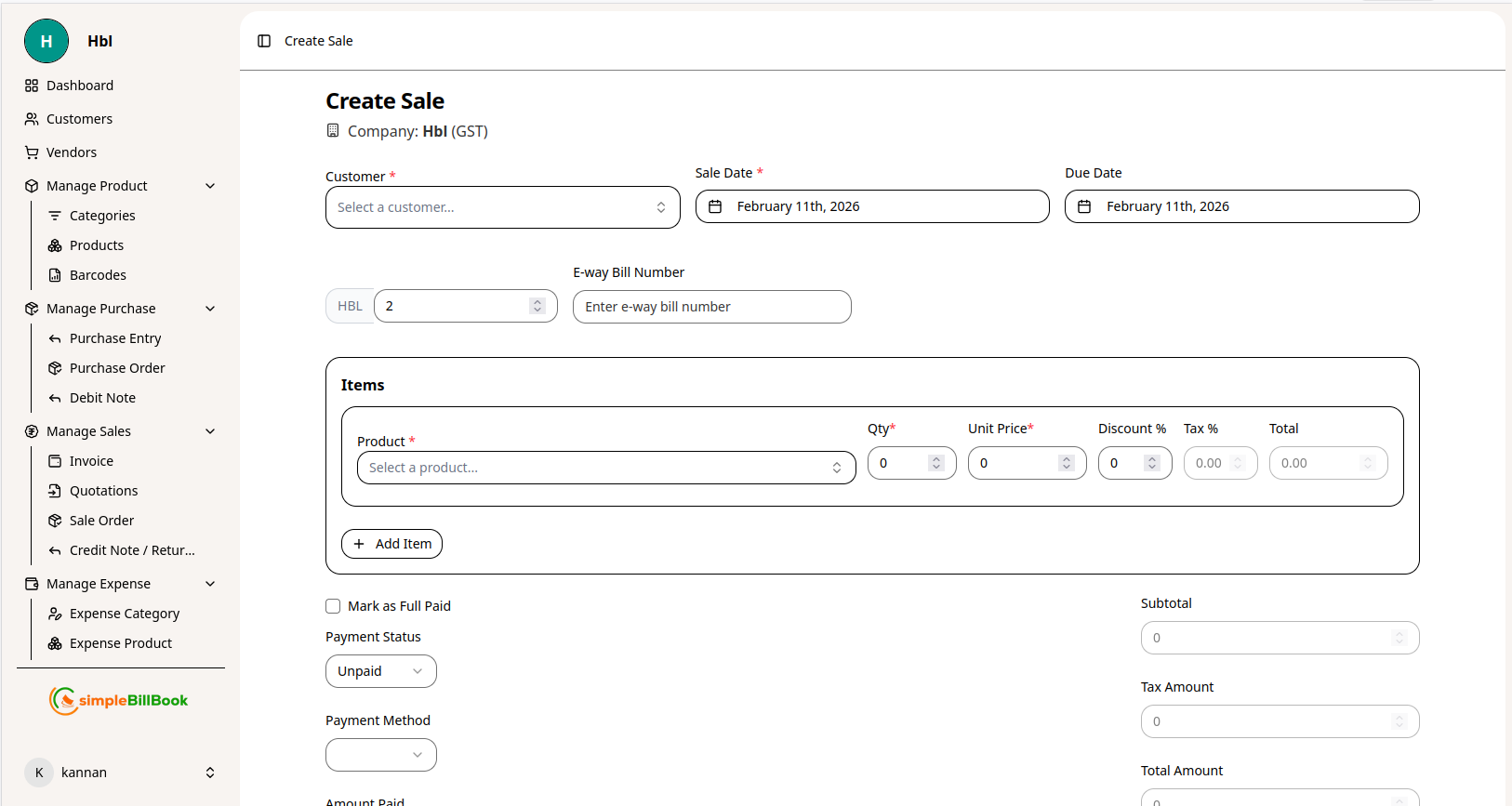

Creating a New Sales Invoice

Step 1: Access Invoice Creation

From the sales invoices page, click Create Sale or similar button.

Step 2: Fill Invoice Details

Figure 2: Form for creating new sales invoices

Figure 2: Form for creating new sales invoices

Header Information:

- Customer*: Select customer from dropdown (required)

- Invoice Number: Auto-generated based on settings (e.g., HBL 2)

- E-way Bill Number: For GST compliance (if applicable)

- Company Details: Auto-filled from company settings

Item Selection:

- Click + Add Item to add products to the invoice

- Select Product from dropdown

- Enter quantity, unit price, and other details:

Item Columns:

- Product: Item name from inventory

- Qty*: Quantity sold (required)

- Unit Price*: Selling price per unit (required)

- Discount %: Percentage discount applied

- Tax %: Applicable tax rate

- Total: Line item total (auto-calculated)

Payment Information:

- Payment Method: Select payment type (Cash, Card, Bank Transfer, etc.)

- Amount Paid: Enter amount received at time of sale

- Payment Status: Auto-updates based on amount paid vs. total

Tax Calculations:

- VAT Rate: Value Added Tax rate

- VAT Amount: Calculated tax amount

- VAT Due Date: Tax payment deadline

- Total with Tax: Final amount including taxes

Step 3: Save Invoice

- Save as Draft: Save for later completion

- Save and Print: Save and generate printable invoice

- Save and Send: Save and email to customer

- Cancel: Discard the invoice

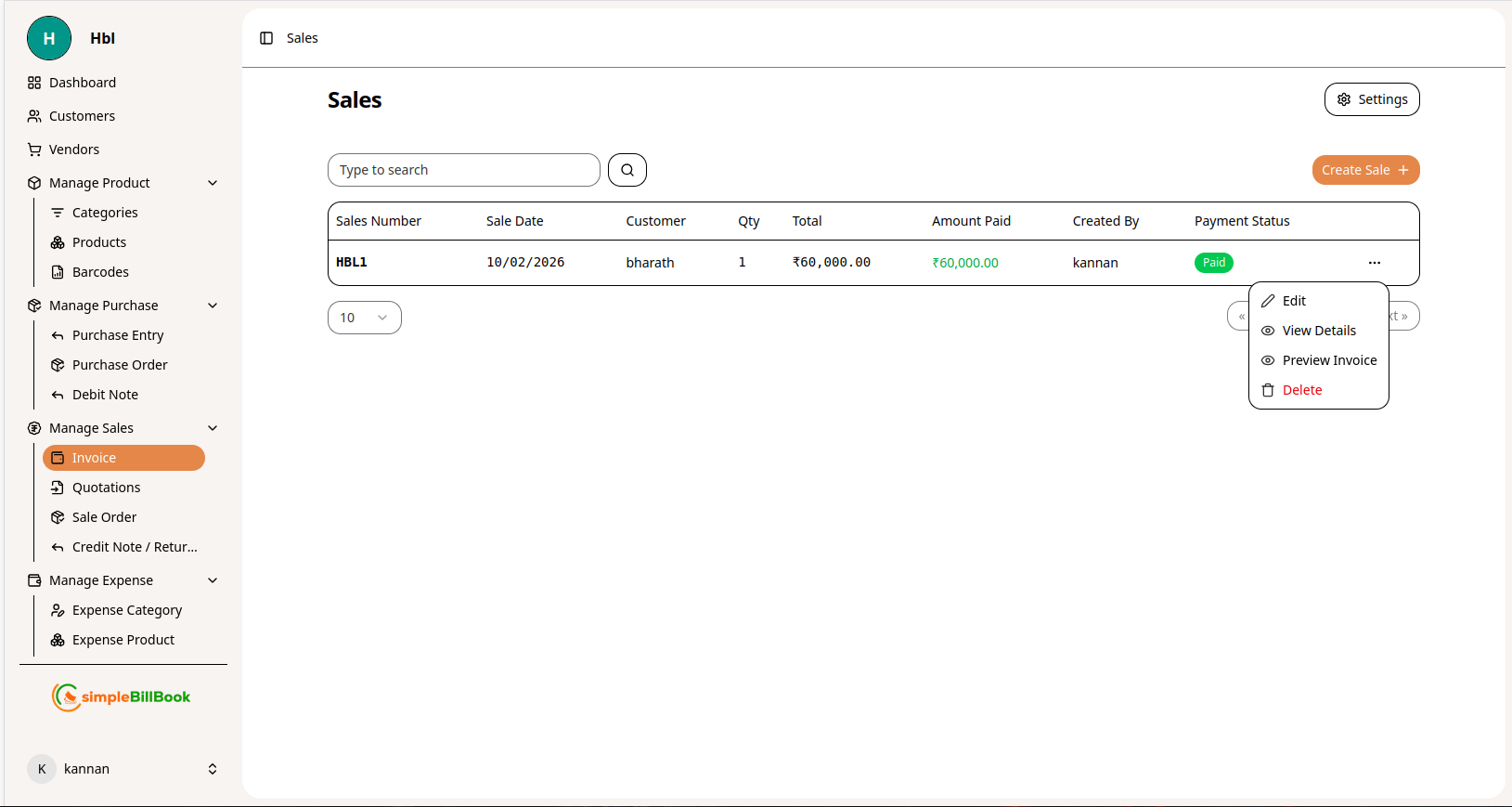

Invoice Actions and Management

Available Invoice Actions:

Figure 3: Sales invoice with available action buttons

Figure 3: Sales invoice with available action buttons

Common Actions on Invoices:

- View: See complete invoice details

- Edit: Modify invoice (if not finalized)

- Print: Generate printable version

- Email: Send to customer electronically

- Duplicate: Create similar invoice quickly

- Void/Cancel: Mark as cancelled

- Payment: Record additional payments

Payment Processing:

- Locate invoice in list

- Click Payment or similar action

- Enter payment amount and method

- Update payment status

- Generate receipt if needed

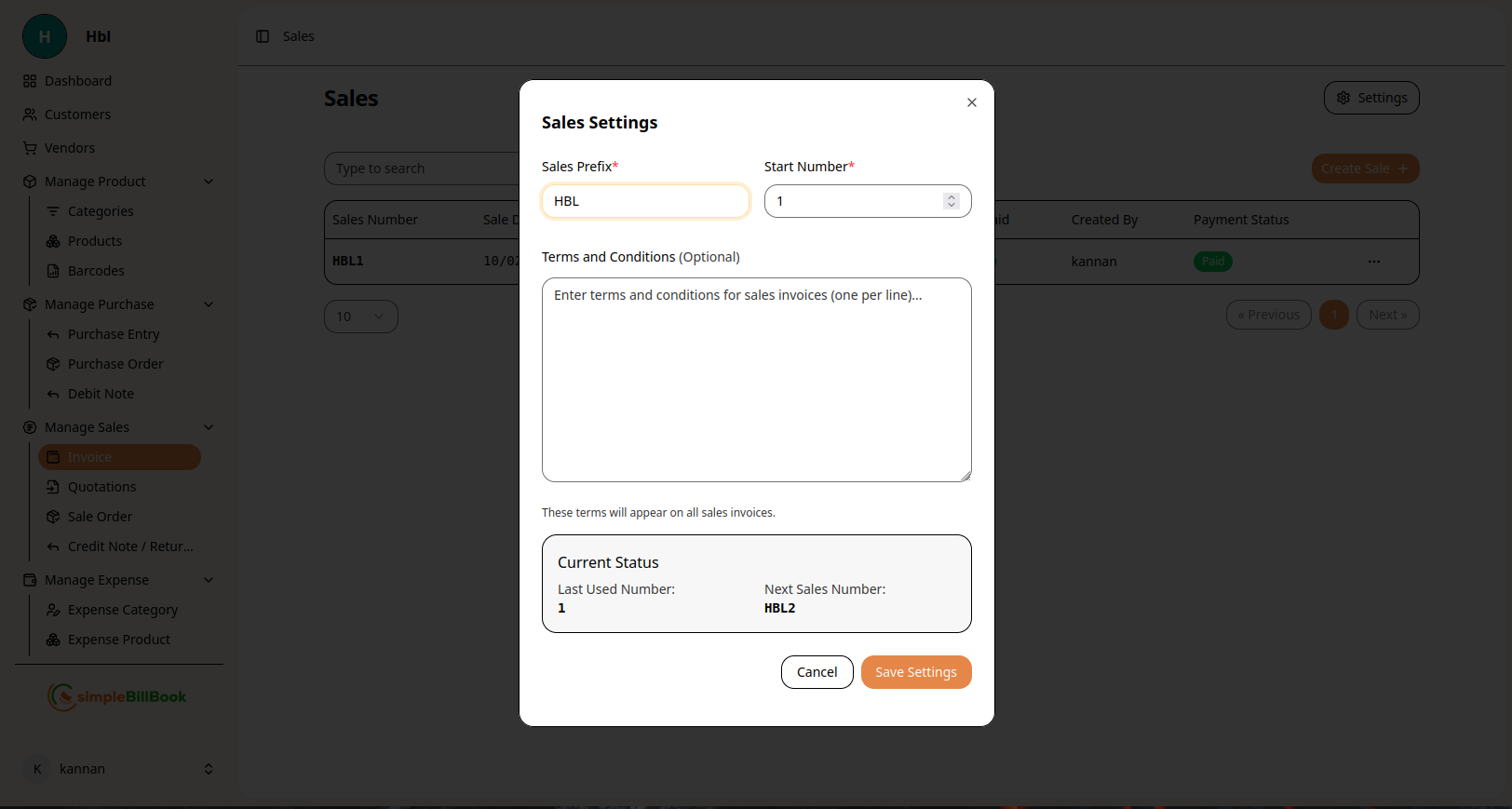

Invoice Settings Configuration

Accessing Invoice Settings

From the sales management section, access settings via gear icon or Settings menu.

Figure 4: Invoice numbering and configuration settings

Figure 4: Invoice numbering and configuration settings

Configurable Settings:

Invoice Numbering:

- Sales Prefix*: Custom prefix for invoice numbers (default: HBL)

- Start Number*: Beginning sequence number (required)

- Last Used Number: System tracks last generated number

- Next Sales Number: Preview of next auto-generated number

Terms and Conditions:

- Default Terms: Standard terms for all invoices

- Payment Terms: Default payment conditions (Net 30, Due on receipt, etc.)

- Return Policy: Standard return conditions

Tax Configuration:

- Default Tax Rate: Standard tax rate for items

- Tax Calculations: Configure tax inclusion/exclusion

- Tax Identification: Company tax details

Display Settings:

- Invoice Template: Select invoice layout and design

- Company Logo: Upload logo for invoice header

- Footer Text: Custom footer text

Saving Settings:

- Click Save Settings to apply changes

- Use Cancel to discard modifications

- Settings affect all future invoices

Sales Invoice Workflow

Complete Sales Process:

1. Preparation Stage:

- Ensure customer exists in system

- Verify product availability

- Check pricing and discounts

2. Invoice Creation:

- Select customer

- Add items with quantities and prices

- Apply discounts if applicable

- Calculate taxes

3. Payment Processing:

- Record payment method

- Enter amount paid

- Generate payment receipt

- Update inventory stock

4. Documentation:

- Print or email invoice

- File copy for records

- Update customer account

5. Post-Sale:

- Track outstanding payments

- Send payment reminders

- Handle returns if needed

- Update sales reports

Types of Sales Transactions

1. Cash Sales

- Immediate payment received

- Inventory updates immediately

- Simple transaction flow

2. Credit Sales

- Payment deferred to future date

- Customer account charged

- Payment terms apply

3. Partial Payment Sales

- Some amount paid at time of sale

- Balance recorded as receivable

- Follow-up required for balance

4. Proforma Invoices

- Preliminary invoices for quotation

- No inventory impact

- Can convert to actual invoice

Best Practices for Invoice Management

Creating Accurate Invoices:

- Complete Customer Information: Ensure all customer details are correct

- Accurate Item Selection: Double-check products and quantities

- Correct Pricing: Verify selling prices and discounts

- Tax Compliance: Ensure proper tax calculations

- Clear Terms: State payment terms clearly

Payment Management:

- Immediate Recording: Record payments as soon as received

- Receipt Issuance: Provide receipts for all payments

- Outstanding Tracking: Monitor unpaid invoices regularly

- Payment Reminders: Send timely payment reminders

Customer Communication:

- Prompt Invoicing: Send invoices immediately after sale

- Clear Documentation: Ensure invoices are easy to understand

- Professional Format: Use professional invoice templates

- Multiple Channels: Offer print and electronic options

Record Keeping:

- Organized Filing: Maintain organized invoice records

- Backup Systems: Keep digital and physical backups

- Audit Trail: Maintain complete transaction history

- Regular Reconciliation: Reconcile sales with bank deposits

Integration with Other Modules

Customer Management:

- Sales History: Tracks all transactions with each customer

- Credit Limits: Monitors customer credit utilization

- Payment Patterns: Analyzes customer payment behavior

Inventory Management:

- Stock Reduction: Inventory automatically decreases on sale

- Stock Alerts: Can trigger low stock warnings

- Sales Analysis: Identifies fast-moving vs. slow-moving items

Financial Accounting:

- Revenue Recording: Sales recorded as income

- Receivable Tracking: Monitors outstanding customer balances

- Tax Reporting: Captures output tax liabilities

Reporting and Analytics:

- Sales Reports: Daily, weekly, monthly sales summaries

- Customer Analysis: Sales by customer category

- Product Performance: Best-selling items analysis

- Payment Collection: Collection efficiency metrics

Common Scenarios and Solutions

Scenario 1: Partial Delivery

Solution:

- Create invoice for delivered items only

- Note pending items for future delivery

- Create separate invoice when remaining items delivered

Scenario 2: Price Negotiation After Sale

Solution:

- Create credit note for price difference

- Or issue refund if already paid

- Document reason for adjustment

Scenario 3: Customer Requests Proforma

Solution:

- Create proforma invoice with estimated amounts

- Mark clearly as "Proforma" or "Quotation"

- Convert to actual invoice when order confirmed

Scenario 4: Bulk Order with Discount

Solution:

- Apply percentage discount to entire invoice

- Or apply fixed amount discount

- Ensure discount calculation is clear on invoice

Scenario 5: Tax-Exempt Customer

Solution:

- Verify customer tax exemption certificate

- Set tax rate to 0% for that customer

- Document exemption details

Reports and Analytics

Available Sales Reports:

- Sales Summary: Total sales by period

- Outstanding Invoices: All unpaid invoices aging report

- Customer Statements: Detailed statements per customer

- Product Sales: Sales performance by product

- Tax Reports: Sales tax collected and payable

- Collection Efficiency: Payment collection performance

Key Metrics to Monitor:

- Days Sales Outstanding (DSO): Average collection period

- Sales Growth: Month-over-month sales increase

- Collection Rate: Percentage of invoices paid on time

- Average Invoice Value: Average sale amount

- Customer Retention: Repeat customer sales