Debit Note Management

Debit Notes in Hbl's simpleBillBook are used to record returns, damages, or adjustments to vendor purchases. They help maintain accurate vendor accounts and inventory records when goods need to be returned or when price adjustments are required.

Overview of Debit Notes

Debit Notes serve several purposes:

- Purchase Returns: Return defective or incorrect goods to vendors

- Damage Claims: Record damaged items received from vendors

- Price Adjustments: Correct pricing errors from vendors

- Quantity Adjustments: Adjust for short shipments or overcharges

- Warranty Claims: Process warranty returns to vendors

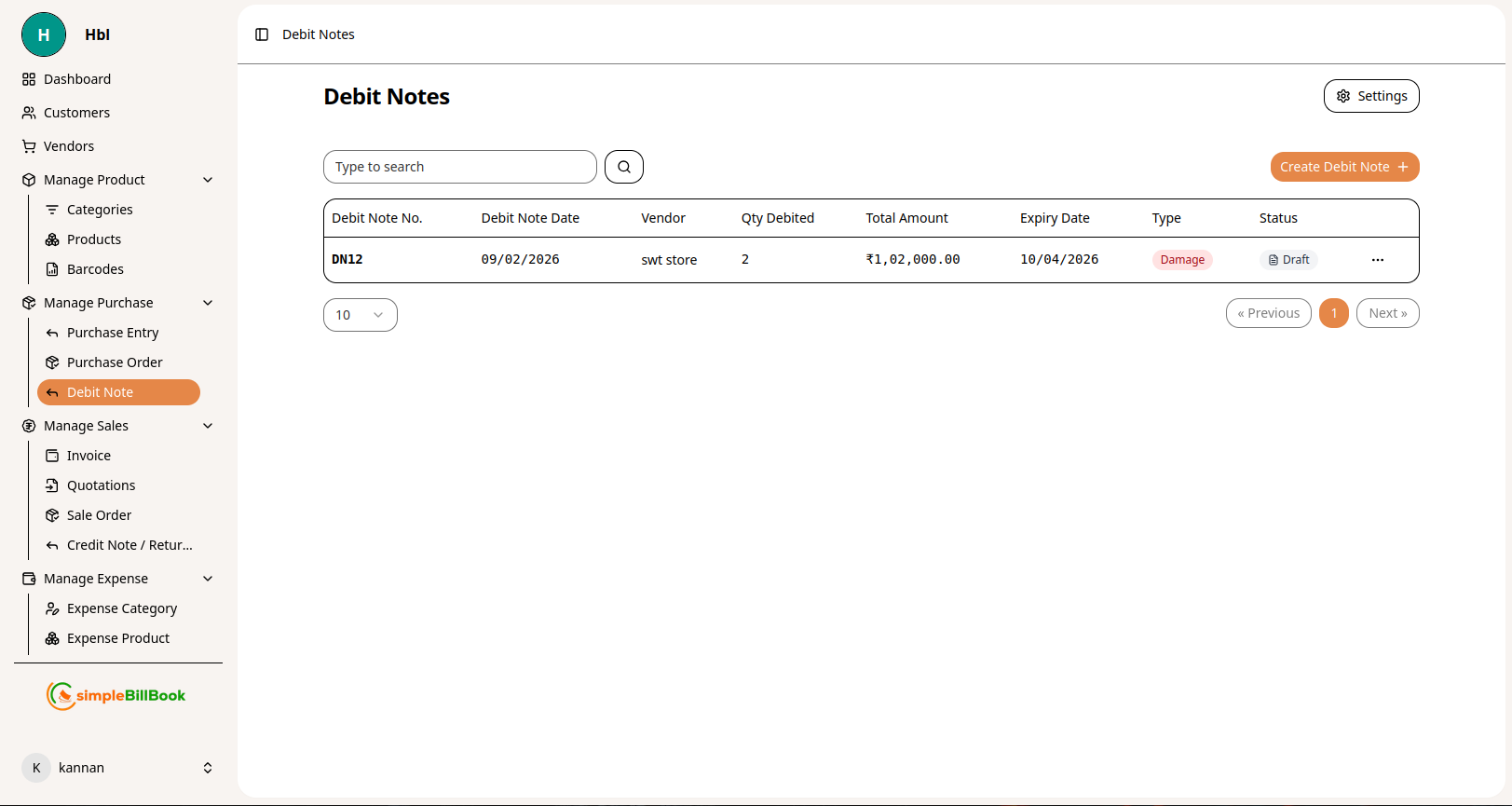

Viewing Debit Notes

To view all debit notes:

- Navigate to Manage Purchase → Debit Note from the main sidebar

- You'll see a table listing all debit notes with their details

Figure 1: Debit notes list showing all debit notes with status and details

Figure 1: Debit notes list showing all debit notes with status and details

Debit Note Table Columns:

Identification:

- Debit Note No.: Unique identifier (e.g., DN12)

- Debit Note Date: Date when debit note was created

- Vendor: Vendor name

- Type: Reason for debit note (Damage, Return, Adjustment, etc.)

Quantitative Details:

- Qty Debited: Total quantity of items returned/adjusted

- Total Amount: Financial value of the debit note

Administrative Information:

- Expiry Date: Validity period for the debit note

- Status: Current status (Draft, Sent, Approved, Processed)

- Created By: User who created the debit note

Navigation and Search:

- Type to search: Search by debit note number, vendor, or type

- Pagination: Navigate through pages (Previous, 1, Next)

- Items per page: Display 10 items per page (configurable)

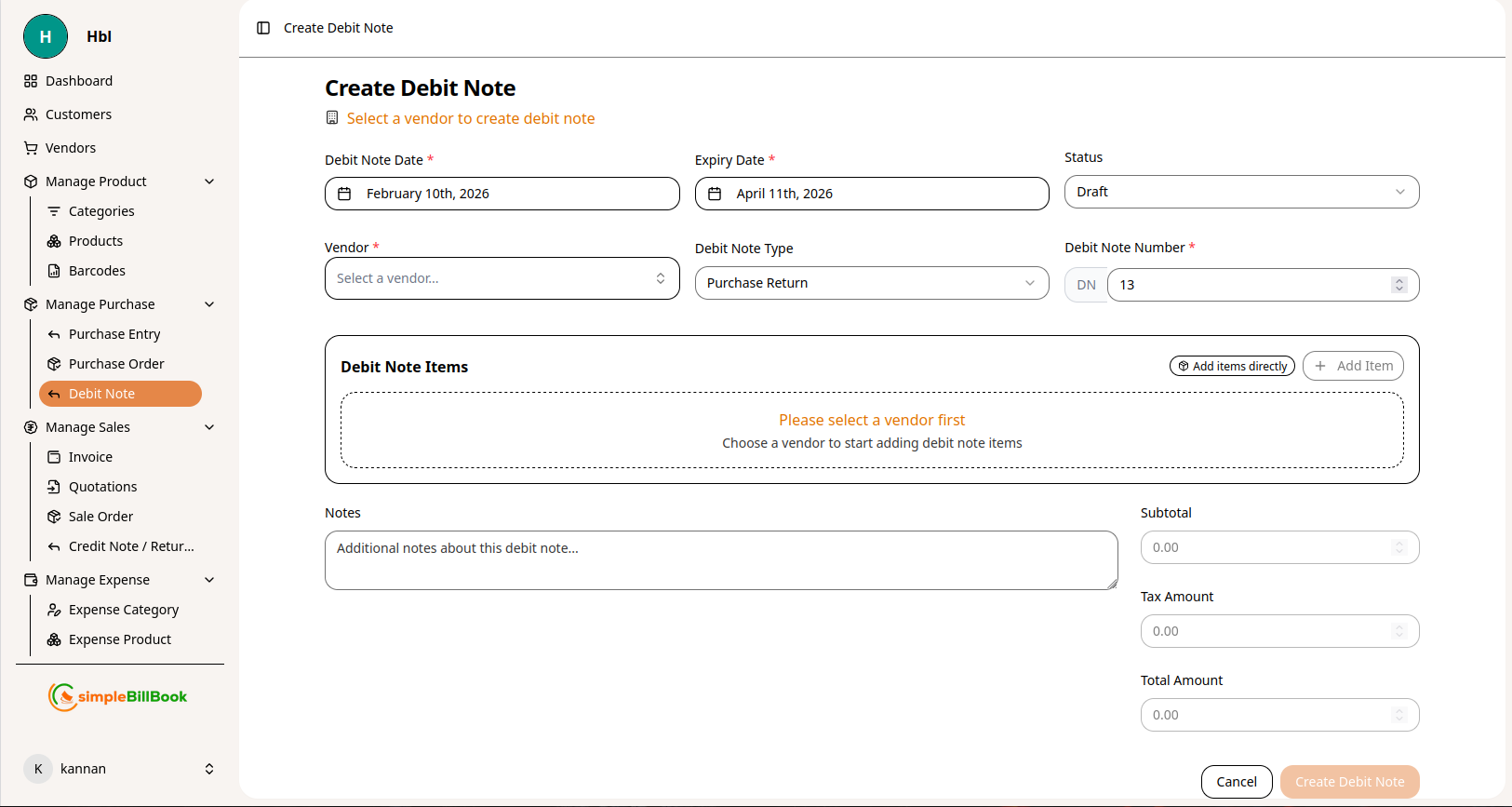

Creating a New Debit Note

Step 1: Access Debit Note Creation

From the debit notes page, click Create Debit Note or similar button.

Step 2: Fill Debit Note Details

Figure 2: Form for creating new debit notes

Figure 2: Form for creating new debit notes

Header Information:

- Vendor*: Select vendor from dropdown (required)

- Debit Note Date: Auto-filled with current date (editable)

- Expiry Date: Validity period for the debit note

- Debt Note Type: Select type (Purchase Return, Damage, etc.)

- Debit Note No.: Auto-generated based on settings (e.g., DN 13)

- Status: Defaults to "Draft" (can be changed to "Sent")

Item Selection:

- After selecting a vendor, you can add items

- Select products from vendor's purchase history

- Enter quantities to debit and reasons

- System shows original purchase details for reference

Notes and Financials:

- Notes: Add detailed explanation for the debit note

- Subtotal: Sum of all item values before tax

- Tax Amount: Calculated tax adjustments

- Total Amount: Final amount to be debited from vendor

Step 3: Save Debit Note

- Save as Draft: Save for later editing or approval

- Create Debit Note: Finalize and create the debit note

- Cancel: Discard the debit note

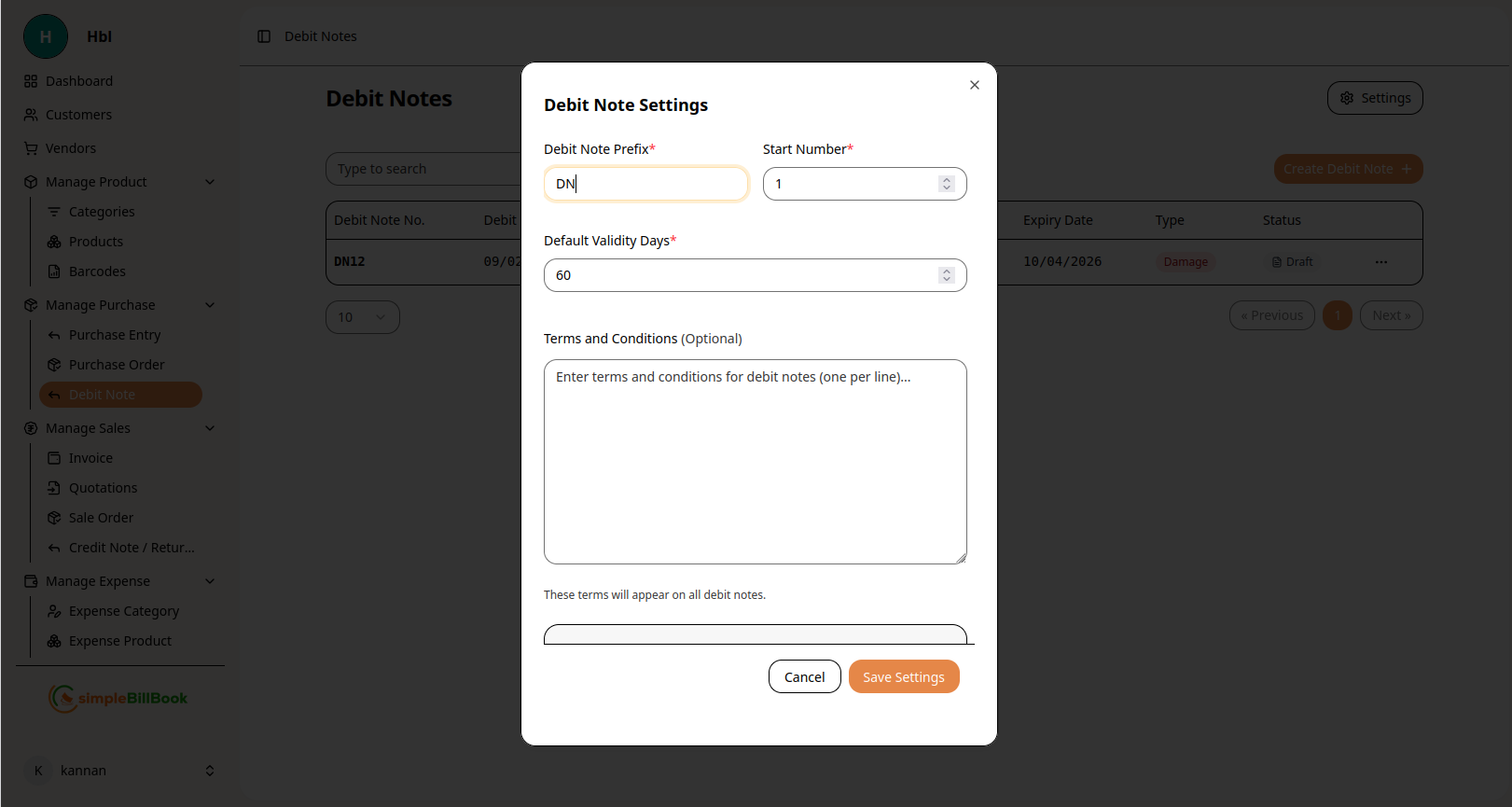

Debit Note Settings

Accessing Debit Note Settings

From the debit notes page, click Settings to configure defaults.

Figure 3: Configuration settings for debit notes

Figure 3: Configuration settings for debit notes

Configurable Settings:

Numbering System:

- Debit Note Prefix*: Custom prefix (default: "DN")

- Start Number: Beginning sequence number

- Default Validity Days*: Number of days debit notes remain valid

Terms and Conditions:

- Default Terms: Enter standard terms (one per line)

- Return Policies: Specify return conditions and timelines

- Approval Requirements: Set approval workflows if needed

Type Categories:

- Debit Note Types: Define standard reasons (Damage, Return, Adjustment, etc.)

- Default Type: Set most common type as default

Saving Settings:

- Click Save Settings to apply changes

- Use Cancel to discard modifications

- Settings affect all future debit notes

Debit Note Workflow

Typical Debit Note Lifecycle:

1. Creation Stage (Status: Draft)

- Debit note created with items and reasons

- Can be edited and modified

- Not yet communicated to vendor

2. Review Stage (Status: Pending Review)

- Internal review for accuracy

- Approval from manager if required

- Documentation verification

3. Communication Stage (Status: Sent)

- Sent to vendor for acknowledgment

- Vendor may accept or dispute

- Negotiation if required

4. Processing Stage (Status: Approved/Processed)

- Vendor accepts debit note

- Adjustments made to vendor account

- Inventory updated if items returned

5. Settlement Stage (Status: Settled)

- Credit issued by vendor

- Payment adjusted in next invoice

- Case closed

6. Rejection Stage (Status: Rejected/Cancelled)

- Vendor disputes and debit note rejected

- Case closed or renegotiated

- Alternative resolution sought

Types of Debit Notes

1. Purchase Return Debit Notes

- Purpose: Return defective, incorrect, or excess goods

- Impact: Reduces inventory, creates vendor credit

- Timing: Usually within return period specified in purchase terms

2. Damage Claim Debit Notes

- Purpose: Claim for damaged goods received

- Impact: Reduces payable to vendor

- Documentation: Photos, inspection reports often required

3. Price Adjustment Debit Notes

- Purpose: Correct pricing errors from vendor invoices

- Impact: Adjusts purchase cost

- Basis: Based on purchase agreements or quoted prices

4. Quantity Adjustment Debit Notes

- Purpose: Adjust for short shipments or measurement errors

- Impact: Reduces payable for missing quantities

- Verification: Based on receiving reports

5. Warranty Return Debit Notes

- Purpose: Return items under warranty

- Impact: Vendor provides replacement or credit

- Conditions: Must meet warranty terms

Best Practices for Debit Note Management

Creating Effective Debit Notes:

- Clear Documentation: Include photos, inspection reports for damages

- Specific Reasons: Use precise descriptions for return reasons

- Reference Original Purchase: Link to original purchase entry

- Timely Creation: Create debit notes soon after issue discovery

- Accurate Quantities: Verify quantities before creating debit note

Vendor Communication:

- Professional Tone: Maintain professional communication

- Evidence Sharing: Provide supporting evidence to vendors

- Follow-up System: Track vendor responses and acknowledgments

- Negotiation Record: Document any negotiations or settlements

Internal Processes:

- Approval Workflow: Implement approval for significant debit notes

- Document Retention: Keep all supporting documents

- Regular Review: Review pending debit notes regularly

- Performance Tracking: Monitor debit note resolution times

Integration with Other Modules

Vendor Management:

- Account Adjustments: Debit notes reduce vendor payable balances

- Performance Tracking: Tracks vendor quality issues

- Relationship Management: Helps in vendor evaluation

Inventory Management:

- Stock Adjustments: Returned items reduce inventory levels

- Quality Control: Tracks defective items by vendor

- Cost Adjustments: Updates average cost when prices adjusted

Purchase Management:

- Purchase History: Links debit notes to original purchases

- Account Reconciliation: Helps reconcile vendor statements

- Future Purchasing: Informs future vendor selection

Financial Accounting:

- Account Payable: Reduces accounts payable

- Expense Adjustments: Corrects expense recording

- Tax Adjustments: Handles tax reversals on returns

Common Scenarios and Solutions

Scenario 1: Partial Shipment of Defective Goods

Solution:

- Create debit note for defective items only

- Keep good items in inventory

- Request replacement for defective items

- Or take credit for defective portion

Scenario 2: Price Discrepancy Discovered Late

Solution:

- Create price adjustment debit note

- Reference original purchase and agreed prices

- Negotiate with vendor for retroactive adjustment

- Adjust inventory cost if already sold

Scenario 3: Vendor Disputes Debit Note

Solution:

- Provide all supporting documentation

- Escalate to higher authority if needed

- Consider partial settlement if appropriate

- Document resolution for future reference

Scenario 4: Time-Sensitive Returns

Solution:

- Create debit note immediately upon discovery

- Mark with high priority if time-sensitive

- Follow up with vendor promptly

- Consider alternative resolutions if vendor unresponsive

Reports and Analytics

Available Debit Note Reports:

- Open Debit Notes: All pending debit notes by vendor

- Debit Note Aging: How long debit notes have been pending

- Vendor Return Analysis: Returns by vendor and reason

- Value of Returns: Financial impact of returns

- Resolution Time: Average time to resolve debit notes

Key Metrics to Monitor:

- Debit Note Rate: Percentage of purchases resulting in debit notes

- Resolution Time: Average days to resolve debit notes

- Vendor Performance: Return rates by vendor

- Financial Impact: Total value of debit notes by period